Products You May Like

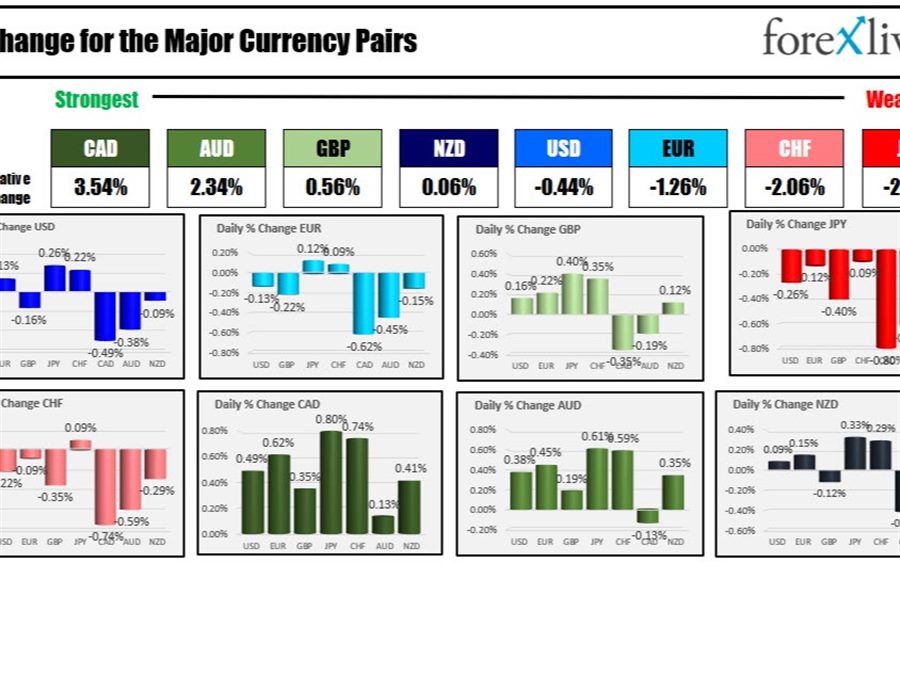

As the North American session begins, the CAD is the strongest and the JPY is the weakest of the major currencies. The USD is mixed ahead of the FOMC decision today.

The last sleep is over. The Fed decision will be made today with lots for Chair Powell to work through including taper (will they speed it up or end it?), rate trajectory (do they speak to a March hike?), and balance sheet reduction (QT or no QT and when will it start?). The decision will take place at 2 PM ET with the press conference scheduled for 2:30 PM ET. There will be no central tendencies or dot plot this meeting (the Fed releases those on a every-other meeting schedule and in December they projected 3 hikes in 2022). However, the press will likely look to get whether Powell is expecting a change to 4 hike in 2022 given the persistently high inflation. The next meeting is the March meeting where the market is expecting a 0.25% basis point hike. As a result, if the chair is to telegraph policy, this would be the meeting to get it all out.

Ahead of the Fed decision will be the Bank of Canada announcement at 10 AM ET. They will also publish its quarterly Monetary Policy Report (MPR) alongside the rate statement. A press conference will follow at 10:15 with Governor Macklem. The market is pricing in a 70% chance that the central bank raises rates by 0.25%. At their last meeting, the said they would not raise rates until midyear, but higher inflation (4.8% – 30 year high and well above the 2% target) and strong housing market has the potential to speed up those plans despite omicron concerns.

Stocks are higher in pre-market trading helped by strong forecast from Microsoft which helped propel the stock higher after some shaky trading soon after the results which showed beats on the top and bottom line, but not by enough. The projections/guidance helped to save the day, and turn the market around.

Boeing announced this morning and took some hefty charges as a result of the 787 activities, but the stock is trading higher nevertheless on hopes the worst is behind the beleaguered airline manufacturer.

Tesla, Intel, Lam research, and ServiceNow will report their earnings after the close. Apple will announce after the close tomorrow.

US yields are modestly higher with the 2 year above 1.0% ahead of the Fed meeting.

In other markets, the morning snapshot shows:

- Spot gold is trading down -$2.75 or -0.16% at $1845.15

- Spot silver is up nine cents or 0.4% at $23.90

- WTI crude oil is trading up $0.66 or 0.77% at $86.26

- Bitcoin is trading at $37,861. The digital currency was trading near $37,550 and around 5 PM yesterday

In the premarket for US stocks, the major indices are trading higher help by Microsoft earnings and upbeat sales forecast. That is helping to squeeze market ahead of the FOMC decision later today

- Dow industrial average up 346 points after falling -66.77 points yesterday

- S&P index up 60 points after yesterday’s -53.68 point decline

- NASDAQ index up 265 points after falling -315.83 points yesterday

In the European equity markets, major indices are also rebounding after the sharp declines yesterday

- German DAX, is up 2.2%

- France’s CAC is up 2.2%

- UK’s FTSE 100 is up 1.75%

- Spain’s Ibex it is up 2.2%

- Italy’s FTSE MIB is up 1.84%

The US 10 year yield is trading marginally higher with the two year up 1.2 basis points. The 10 year is up 0.7 basis points. The U.S. Treasury has been successful and auction off two and five year notes this week. The treasury will take today off with the FOMC decision at 2 PM ET. They will auction off seven year notes tomorrow at 1 PM ET

In the European debt market, the benchmark 10 year yields are also trading marginally higher. The UK 10 year is the strongest at +2.4 basis points. German 10 year yield still remains negative at -0.075%