Products You May Like

Investor sentiment was basically destroyed by more hawkish than expected Fed Chair Jerome Powell. US stocks reversed earlier gains and closed mixed. But futures are already pointing to a gap down open today. Major Asia indexes are trading in deep red. Markets are now expecting as many as five rate hikes this year starting March.

In the currency markets, Dollar is currently the strongest one for the week, followed by Yen. New Zealand Dollar is the worst, followed by Aussie. Canadian Dollar is just mixed as partly support by BoC hike expectations and rally in oil prices. European majors are mixed for now.

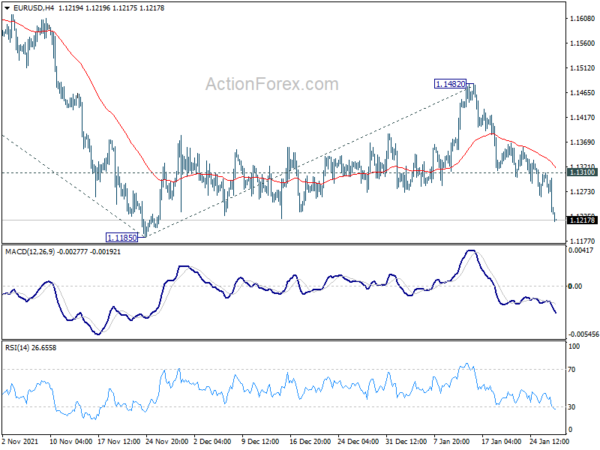

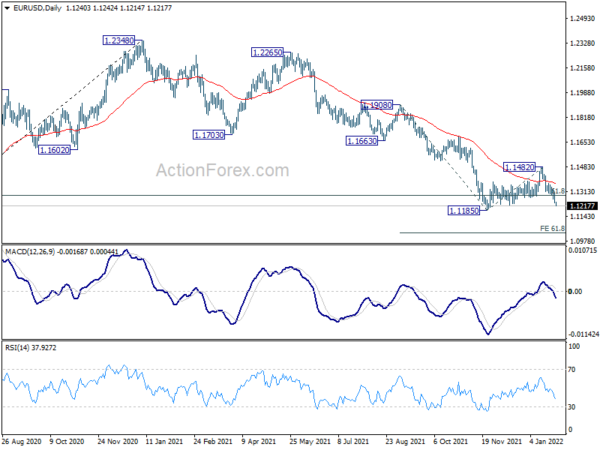

Technically, focus is quickly back on 1.1185 low in EUR/USD. Firm break there will confirm resumption of larger down trend from 1.2348. At the same time, we’ll monitor the momentum of some Dollar pairs towards corresponding level. They 1.3158 low in GBP/USD, 0.6992 low in AUD/USD, and 1.2963 high in USD/CAD. By the way, NZD/USD has broken equivalent level of 0.6700 earlier this week already.

In Asia, at the time of writing, Nikkei is down -3.02%. Hong Kong HSI is down -2.54%. China Shanghai SSE is down -1.20%. Singapore Strait Times is down -0.36%. Japan 10-year JGB yield is up 0.0162 at 0.156. Overnight, DOW dropped -0.38%. S&P 500 dropped -0.15%. NASDAQ rose 0.02%. 10-year yield rose 0.065 to 1.848.

Suggested readings on Fed:

NASDAQ rejected by 14k after hawkish Fed, risks heavily on the downside

US stock markets tumbled sharply overnight and futures dive further in Asian session. Fed Chair Jerome Powell sounded very hawkish during the post meeting press conference. The indication that rate hikes would start in March wasn’t much of a surprise. But Powell indicated that every meeting in “live” and refused to rule out 50bps hikes. Some economists are now forecasting as many as five hikes this year.

On inflation, Powell also warned “are still to the upside in the views of most FOMC participants, and certainly in my view as well”. And, “there’s a risk that the high inflation we are seeing will be prolonged. There’s a risk that it will move even higher. So, we don’t think that’s the base case, but, you asked what the risks are, and we have to be in a position with our monetary policy to address all of the plausible outcomes,”

NASDAQ was rejected by 14k psychological level and 38.2% retracement 15319.03 to 13094.65 at 13944.36 to close flat. The development keeps near term risks heavily on the downside. Immediate focus is back on 13414.14 support. Break firm break there will argue that the free fall from 16212.22 is resuming. Next target will be 38.2% retracement of 6631.42 to 16212.22 at 12552.35.

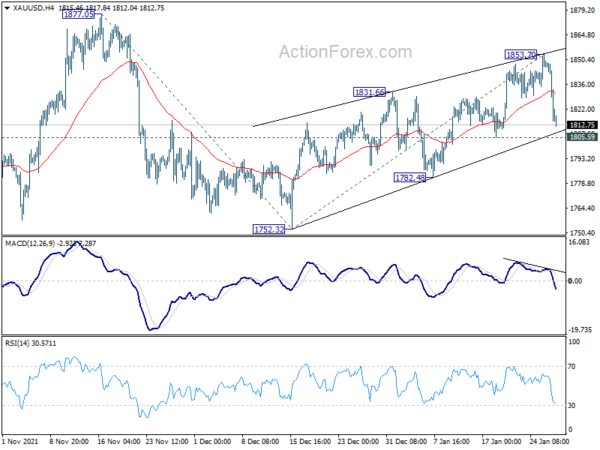

Gold dives on strong Dollar, 1805 support in focus

Gold dropped sharply overnight following broad based Dollar strength. The development now raises the chance that rebound from 1752.32 has completed with three waves up to 1853.70 Immediate focus is now on 1805.59 support. Firm break there should add more credence to this bearish case and send Gold through 1782.48 to 1752.32 support.

More importantly, rejection by medium term trend line resistance, together with the corrective structure of the rise from 1752.32 to 1853.70, suggests that medium term sideway pattern is extending with another falling leg. Break of 1782.48 support will open up the case for deeper decline to 100% projection of 1877.05 to 1752.32 from 1853.70 at 1728.97 eventually.

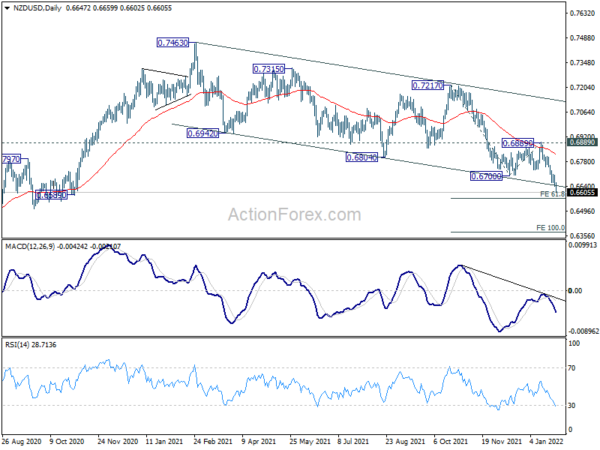

New Zealand CPI surges to 5.9% yoy, NZD/USD dives on risk aversion

New Zealand CPI rose 1.4% qoq in Q4, above expectation of 1.2% yoy. Annual rate accelerated from 4.9% yoy to 5.9% yoy, above expectation of 5.6% yoy. That’s the highest level in three decades since 1990.

“New Zealand is not alone, with many other OECD countries experiencing higher inflation than in recent decades,” consumers prices senior manager Aaron Beck said. “Price increases were widespread with 10 out of 11 main groups in the CPI basket increasing in the year, with only the communications group decreasing.”

The data reinforces the case for RBNZ to raise interest rate in February. Westpac is forecasting a series of OCR hikes over the coming year with cash rat peaking at 3% in 2023. But New Zealand Dollar tumbles broadly following deep risk-off sentiment.

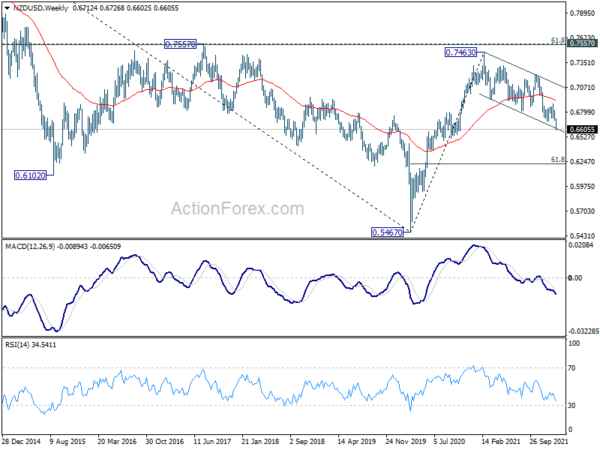

NZD/USD dives to as low as 0.6602 so far today as down trend continues. Next target is 61.8% projection of 0.7217 to 0.6700 from 0.6889 at 0.6569 and then 100% projection at 0.6372.

The strong break of medium term falling channel support indicates downside acceleration. Fall from 0.7463 could be a correction to up trend from 0.5467, or a impulsive down trend itself. In either case, NZD/USD would target 61.8% retracement of 0.5467 to 0.7463 at 0.6229 before making a bottom.

Elsewhere

Australia Westpac leading index rose 0.0% mom in December. Import prices rose 5.8% qoq in Q4, above expectation of 1.4% qoq.

Germany Gfk consumer confidence and Swiss trade balance will be released in European session. US will release jobless claims, GDP, durable goods orders and pending homes sales later in the day.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1216; (P) 1.1263; (R1) 1.1291; More…

EUR/USD’s fall from 1.1482 accelerates lower today and intraday bias remains on the downside. Firm break of 1.1185 support will resume larger down trend from 1.2348. Next target is 61.8% projection of 1.1908 to 1.1185 from 1.1482 at 1.1035. On the upside, above 1.1310 minor resistance will turn intraday bias back to the upside, and extend the consolidation from 1.1185 with another rise.

In the bigger picture, there are various ways of interpreting the fall from 1.2348 (2021 high). It could be a correction to rise from 1.0635 (2020 low), the fourth leg of a sideway pattern from 1.0339 (2017 low), or resuming long term down trend. In any case, outlook will now stay bearish as long as 1.1703 support turned resistance holds. Sustained break of 61.8% retracement of 1.0635 to 1.2348 at 1.1289 would pave the way back to 1.0635.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | CPI Q/Q Q4 | 1.40% | 1.20% | 2.20% | |

| 21:45 | NZD | CPI Y/Y Q4 | 5.90% | 5.60% | 4.90% | |

| 23:30 | AUD | Westpac Leading Index M/M Dec | 0.00% | 0.10% | 0.20% | |

| 00:30 | AUD | Import Price Index Q/Q Q4 | 5.80% | 1.40% | 5.40% | |

| 07:00 | EUR | Germany Gfk Consumer Confidence Feb | -8 | -6.8 | ||

| 07:00 | CHF | Trade Balance (CHF) Dec | 5.23B | 6.16B | ||

| 13:30 | USD | Initial Jobless Claims (Jan 21) | 260K | 286K | ||

| 13:30 | USD | GDP Annualized Q4 P | 5.60% | 2.30% | ||

| 13:30 | USD | GDP Price Index Q4 P | 6.00% | 6.00% | ||

| 13:30 | USD | Durable Goods Orders Dec | -0.50% | 2.60% | ||

| 13:30 | USD | Durable Goods Orders ex Transportation Dec | 0.50% | 0.90% | ||

| 15:00 | USD | Pending Home Sales M/M Dec | -0.20% | -2.20% | ||

| 15:30 | USD | Natural Gas Storage | -205B | -206B |