Products You May Like

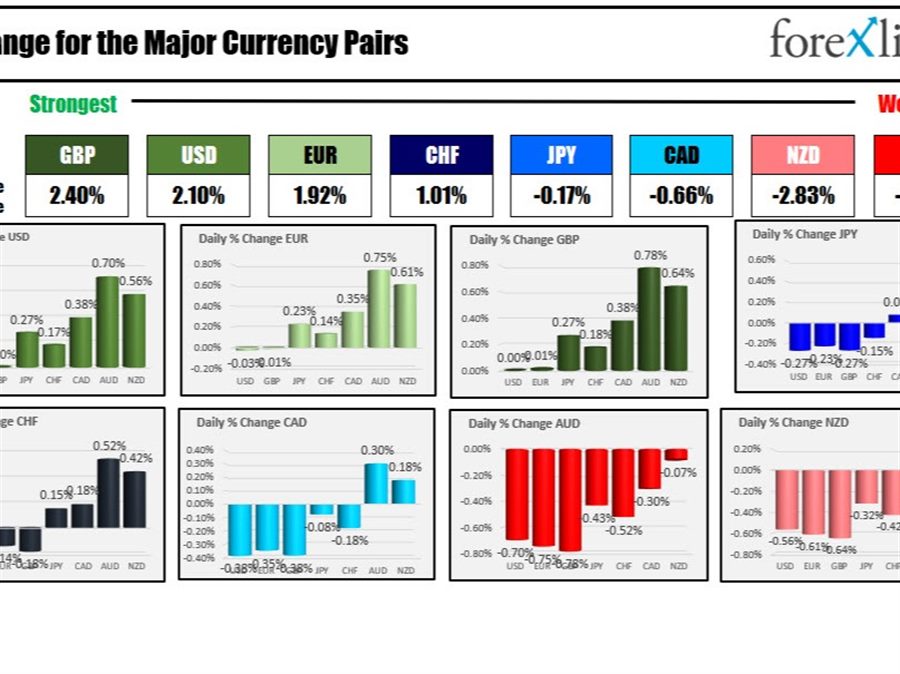

The GBP is the strongest of the majors while the AUD is the weakest as North American traders enter for the day. The USD is stronger and just behind the GBP for the strongest currency today.

Today, the markets will wrestle with PCE (for December) and employment cost index (for the 4th quarter). The PCE is said to be the favored inflation gauge for the FOMC. The core PCE year on year is expected to rise 4.8% versus 4.7% last month. The employment cost index is expected to come in at +1.2% versus 1.3% last month.

US and European stocks are trading lower. US and European yields are higher. Yesterday the US yield curve flattened considerably. Crude oil prices are higher chatter of $100 starting to intensify.

The morning snapshot currently shows:

- Spot gold is trading down $7.80 or -0.42% at $1789.50

- Spot silver is down $0.18 or -0.8% at $22.57

- WTI crude oil is trading up $0.70 at $87.34

- Bitcoin is trading at $36,300. That is down from around $36,700 at 5 PM ET yesterday

In the premarket for US stocks, the major indices are trading lower after yesterday’s down day. The S&P and Dow are working on a three day decline. The NASDAQ is down for the fifth straight week in a row. The Dow and S&P are on track for the fourth week in a row. NASDAQ is up on pace for its worst month since October 2008 (and on pace for the worst January EVER). The major indices are down today despite Apples better than expected earnings.

- Dow industrial average down -320 points after yesterday’s -7.31 point decline. The Dow has been down

- S&P index down 38 points after yesterday’s -23.42 point decline

- NASDAQ index down 93 points after yesterday’s -189.34 point decline

In the European equity markets, major indices are also moving sharply to the downside

- German DAX, -2.2%

- France’s CAC -2.2%

- UK’s FTSE 100 -1.42%

- Spain’s Ibex -1.8%

- Italy’s FTSE MIB -1.9%

in the US debt market, yields are higher after yesterday’s mixed results where the yield curve flattened dramatically. The two – 10 year’s spread is down to 62 basis points after being as high as 90 just a few weeks ago. The market is pricing in tighter monetary policy but also expecting slower growth/slow inflation as a result (i.e. recession)

The European debt market, the benchmark 10 year yields have moved higher with the German tenure yield moving closer to its parity level. The yield is currently at -0.018% after trading as high as -0.014%.