Products You May Like

Asian markets are cautiously optimistic as worries over Russia-Ukraine situation eased. While there are reports of cyber attacks by Russia on Ukraine’s defence ministry and banks, investors are still calm. If the risks of war do vanish, hopefully, focuses will be turned back to Fed’s tightening pace, which might be shed some lights on by FOMC minutes to be published today.

In the currency markets, major pairs are crosses are largely staying inside last week’s range. Euro had recovered some ground, together with Aussie. The common currency is also supported from mildly hawkish comments from ECB officials. Yen and Swiss Franc had turned weaker. Dollar is mixed for the moment, awaiting guidance from US data and Fed minutes.

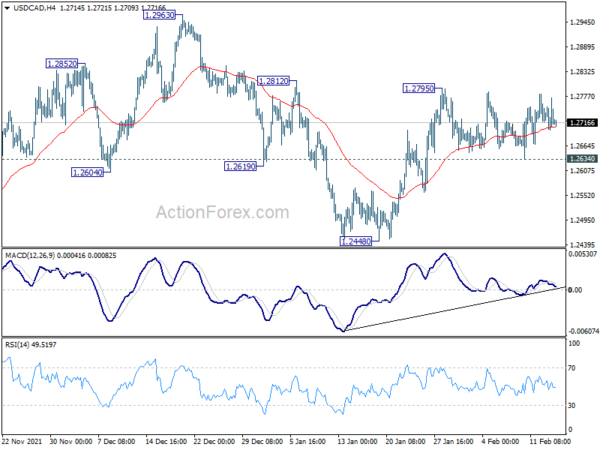

Technically, with Canada CPI also featured, attention will be on USD/CAD today. For now, further rise is expected with 1.2634 support intact. Break of 1.2795 will resume the rally from 1.2448 to retest 1.2963 resistance. But break of 1.2634 will turn focus back to 1.2448 support instead.

In Asia, at the time of writing, Nikkei is up 2.13%. Hong Kong HSI is up 1.31%. China Shanghai SSE is up 0.71%. Singapore Strait Times is up 0.18%. Overnight, DOW rose 1.22%. S&P 500 rose 1.58%, NASDAQ rose 2.53%. 10-year yield rose 0.049 to 2.045.

ECB Schnabel: We should start thinking about gradual normalization of policy

ECB Executive Board member Isabel Schnabel said in an interview, “it has become increasingly likely that inflation is going to stabilise around our 2 per cent target over the medium term.” There, “we should start thinking about a gradual normalization of our policy.”

“With the most recent data, however, the risk of acting too late has increased and therefore we need a careful reassessment of the inflation outlook,” she added.

Schnabel also pointed to a “demand component” in inflation in rising wages, in addition to energy prices and supply chain bottlenecks. She added, “we cannot simply look through everything, especially if inflation now becomes more broad-based and more persistent than we originally thought.”

ECB Villeroy: Any speculation about calendar of rate lift-off is premature

ECB Governing Council member Francois Villeroy de Galhau, useful to have some transition between” the end of emergency PEPP purchases and the regular APP purchases. However, “this reduction could follow a bi-monthly or monthly pace instead of a quarterly one, and APP purchases could therefore end in the third quarter, at some point to be discussed,”

Villeroy also noted current guidance indicated interest rate hikes would come “shortly” after ending asset purchases. But the central bank would have “more scope for fine-tuning” by removing the word “shortly.”

“This would be a possibility to break the quasi-automatic temporal link between the two instruments whilst retaining the sequencing,” he said. “Optionality would mean that the lift-off could possibly take more time, if warranted.”

“We could give ourselves more time and consider the latest inflation outlook before deciding about the calendar of rate hikes – a decision that anyway we don’t need to make before our June meeting,” Villeroy said. “Any speculation about this calendar of future lift-off is at this stage premature.”

Australia Westpac leading index turned positive, signalling above trend growth

Australia Westpac-Melbourne Institute leading index rose from -0.1% to 0.4% in December. That’s the first positive, above trend, read on the since Since Delta outbreak last August. The index signalled that growth outlook has improved with above trend growth over the next three to nine months.

Westpac expects contraction in spending in January due to Omicron, and zero growth in GDP in Q1. But the economy is expected to bounce back strongly over the rest of 2022, with a solid 5.5% growth for the year overall.

Westpac also continues to expect interest rate hike by RBA before August meeting.

Looking ahead

UK PPI and CPI will be the main focus in European session. Eurozone will release industrial production. Later in the day, Canada will release CPI, manufacturing sales and wholesale sales. US will release retail sales, import price, industrial production, business inventories and NAHB housing index. Fed will also publish FOMC minutes.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1318; (P) 1.1343; (R1) 1.1384; More…

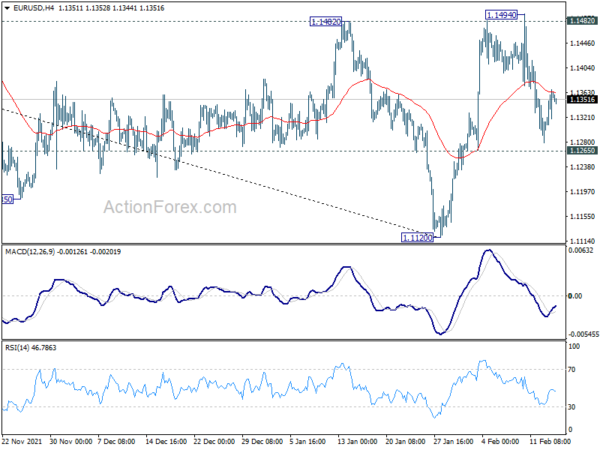

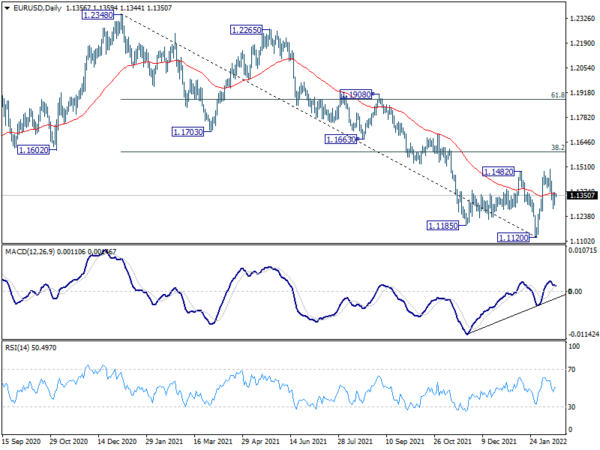

Intraday bias in EUR/USD remains neutral at this point. With 1.1265 minor support intact, further rally will remain mildly in favor. On the upside break of 1.1482 will target 38.2% retracement of 1.2348 to 1.1120 at 1.1589 next. Sustained break there will argue that whole fall from 1.2348 has completed too and target 61.8% retracement at 1.1879. On the downside, however, break of 1.1265 support will dampen this bullish view and bring retest of 1.1120 low instead.

In the bigger picture, the decline from 1.2348 (2021 high) is seen as a leg inside the range pattern from 1.2555 (2018 high). Sustained trading above 55 week EMA (now at 1.1613) will argue that it has completed and stronger rise would be seen back towards top of the range between 1.2348 and 1.2555. However, firm break of 1.0635 (2020 low) will raise the chance of long term down trend resumption and target a retest on 1.0339 (2017 low) next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Leading Index M/M Jan | 0.10% | 0.00% | ||

| 01:30 | CNY | CPI Y/Y Jan | 0.90% | 1.00% | 1.50% | |

| 01:30 | CNY | PPI Y/Y Jan | 9.10% | 9.40% | 10.30% | |

| 04:30 | JPY | Tertiary Industry Index M/M Dec | 0.40% | 0.50% | 0.40% | |

| 07:00 | GBP | CPI Y/Y Jan | 5.50% | 5.40% | ||

| 07:00 | GBP | Core CPI Y/Y Jan | 4.30% | 4.20% | ||

| 07:00 | GBP | RPI Y/Y Jan | 7.40% | 7.50% | ||

| 07:00 | GBP | PPI Input M/M Jan | 0.70% | -0.20% | ||

| 07:00 | GBP | PPI Input Y/Y Jan | 14.20% | 13.50% | ||

| 07:00 | GBP | PPI Output M/M Jan | 0.60% | 0.30% | ||

| 07:00 | GBP | PPI Output Y/Y Jan | 9.40% | 9.30% | ||

| 07:00 | GBP | PPI Core Output M/M Jan | 0.70% | 0.50% | ||

| 07:00 | GBP | PPI Core Output Y/Y Jan | 9.00% | 8.70% | ||

| 10:00 | EUR | Eurozone Industrial Production M/M Dec | 0.30% | 2.30% | ||

| 13:30 | CAD | Manufacturing Sales M/M Dec | 0.00% | 2.60% | ||

| 13:30 | CAD | Wholesale Sales M/M Dec | 2.70% | 3.50% | ||

| 13:30 | CAD | CPI Y/Y Jan | 4.80% | 4.80% | ||

| 13:30 | CAD | CPI Common Y/Y Jan | 2.10% | 2.10% | ||

| 13:30 | CAD | CPI Median Y/Y Jan | 3.10% | 3.00% | ||

| 13:30 | CAD | CPI Trimmed Y/Y Jan | 3.70% | 3.70% | ||

| 13:30 | USD | Retail Sales M/M Jan | 1.80% | -1.90% | ||

| 13:30 | USD | Retail Sales ex Autos M/M Jan | 1.00% | -2.30% | ||

| 13:30 | USD | Import Price Index M/M Jan | 1.30% | -0.20% | ||

| 14:15 | USD | Industrial Production M/M Jan | 0.50% | -0.10% | ||

| 14:15 | USD | Capacity Utilization Jan | 76.70% | 76.50% | ||

| 15:00 | USD | Business Inventories Dec | 2.10% | 1.30% | ||

| 15:00 | USD | NAHB Housing Market Index Feb | 83 | 83 | ||

| 15:30 | USD | Crude Oil Inventories | -2.2M | -4.8M | ||

| 19:00 | USD | FOMC Minutes |