Products You May Like

Here is what you need to know on Friday, March 4:

The financial markets have now gotten over the shock of the initial Russia-Ukraine conflict and had until today begun to price in more risk back into portfolios. However, that has now taken a back seat as news of Russia shelling a nuclear power plant in Ukraine and a fire in the plant sent European markets into a tailspin. The strong jobs report should at least provide some succour to US equitie,s but their European counterparts remain mired. This naturally has sent the dollar on another charge and hits 1.0920 versus the euro. Safe haven buying continues with German bund yields collapsing again, but notably the US yield curve remains on track to turn negative and signal a recession by early 2023.

The dollar index is at 98.67 now on the strong jobs report, Gold is higher at $1,941, and Oil is higher again at $112.10.

European markets are lower: Eurostoxx, FTSE and DAx are all just over 3% lower.

US futures are also lower: S&P, Dow and Nasdaq are all -0.75%

Wall Street Top News (SPY) (QQQ)

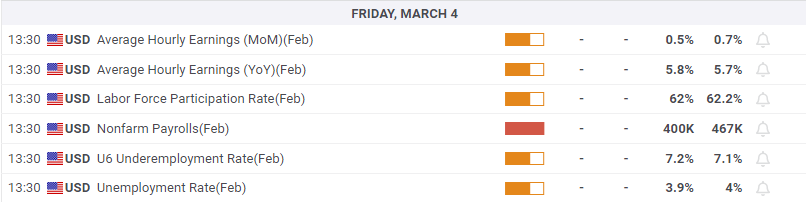

US nonfarm payrolls 678k versus 423k expected.

Apple (AAPL) rumoured to have a folding phone in development-CNBC.

AirBnB (ABNB) suspends all activity in Belarus and Russia.

GAP up 6% after earnings.

ING down 7% on Russian loan exposure.

Stellantis (STLA): Deutsche maintains Buy rating.

Pfizer (PFE) Pfizer Canada recalls blood pressure drug.

Nokia (NOK) sings three-year deal for 4G and 5G across Indonesia.

Smith & Wesson (SWBI) down sharply on earnings.

CRH drops -8% on earnings.

European Banks UBS, BCS, ING Deutsche all down sharply.

Sweetgreen (SG) sets strong guidance, shares up 17%.

Tilray (TLRY) upgraded by Cannacord.

Splunk (SPLK) up on private equity stake.

Broadcom (AVGO) up on strong earnings.

Upgrades and Downgrades

Souce: Benzinga Pro