Products You May Like

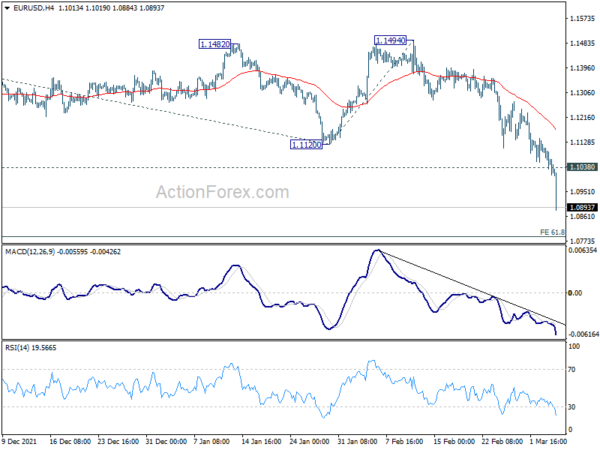

Dollar rises notably in early US session with help from strong headline non-farm payroll job growth, even though wages disappoint. But still, the overwhelming theme is Euro selloff on Russia invasion of Ukraine. The common currency is actually suffering a fresh round of heavy selling, just after NFP risk is cleared.

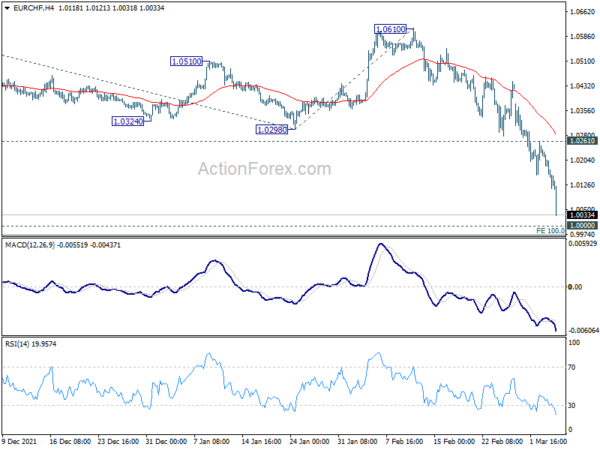

Technically, it shouldn’t be over the top by now, saying that EUR/CHF could even break parity before weekly close, considering the downside momentum. EUR/JPY has also taken out an important long term fibonacci support level at 126.58. EUR/GBP has taken out long term support at 0.8276. Things are getting from bad to worse for Euro.

In Europe, at the time of writing, FTSE is down -2.81%. DAX is down -2.94%. CAC is down -3.24%. Germany 10-year yield is down -0.069 at -0.048. Earlier in Asia, Nikkei dropped -2.23%. Hong Kong HSI dropped -2.50%. China Shanghai SSE dropped -0.96%. Singapore Strait Times dropped -0.83%. Japan 10-year JGB yield dropped -0.0168 to 0.152.

US NFP employment rose 678k in Feb, but wage growth flat

US non-farm payroll employment rose 678k in February, above expectation of 438k. Employment was still down -2.1m, or -1.4% from its pre-pandemic level in February 2020. Job growth was widespread over the month, led by gains in leisure and hospitality, professional and business services, health care, and construction.

Unemployment rate dropped from 4.0% to 3.8%, better than expectation of 3.9%. That’s still above pre-pandemic level of 3.5%. Number of unemployed edged down to 6.3m, above pre-pandemic level of 5.7m. Labor force participation rate was little changed at 62.3%.

Wage growth was a disappointment, however, with average hourly earning rose 0.0% mom, well below expectation of 0.6% mom.

Eurozone retail sales rose 0.2% mom in Jan, EU up 0.6% mom

Eurozone retail sales rose only 0.2% mom in January, well below expectation of 1.5% mom. Volume of retail trade increased by 0.2% for non-food products, remained unchanged for food, drinks and tobacco, and fell by -1.3% for automotive fuels.

EU retail sales rose 0.6% mom. Among Member States for which data are available, the highest monthly increases in the total retail trade volume were registered in Poland (+5.9%), Luxembourg (+4.2%) and Denmark (+3.7%). The largest decreases were observed in Slovenia (-4.6%), Portugal (-2.8%), and Lithuania (-2.5%).

UK PMI construction rose to 59.1, input cost inflation eased

UK PMI Construction rose from 56.3 to 59.1 in February, above expectation of 57.4. Markit said growth was led by marked and accelerated rise in housing activity. Input cost inflation dipped to 11-month low. Business confidence eased to softest since January 2021.

New Zealand ANZ consumer confidence dropped to record low

New Zealand ANZ-Roy Morgan consumer confidence dropped -16 pts to 81.7 in February, hitting a record low since data began in 2004. Inflation expectations were little changed at 5.6% while house price inflation expectations eased from 5.3% to 4.8%.

ANZ said: “This month’s data looks grim, but there are undoubtedly some temporary impacts in there. Time will tell what the other side looks like, but we do know that Omicron is fast and furious, and will blow through relatively quickly.

Australia retail sales rose 1.8% mom in Jan

Australia retail sales rose 1.8% mom to AUD 32.49B in January. Comparing to the same month a year ago, sales rose 6.4% yoy.

“The emergence of the Omicron variant and rising COVID-19 case numbers, combined with an absence of mandated lockdowns has resulted in a range of different consumer behaviours. We have seen the type of spending previously associated with lockdowns occurring simultaneously with those associated with the easing of lockdown conditions,” Director of Quarterly Economy Wide Statistics, Ben James said.

“This had led to variations across the industries with Food retailing recording a rise in sales consistent with previous COVID-19 outbreaks as consumers exercise caution amidst surging case numbers. However, the absence of lockdowns meant that other discretionary industries which would usually see a fall during the pandemic have recorded mixed results.”

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1026; (P) 1.1074; (R1) 1.1114; More…

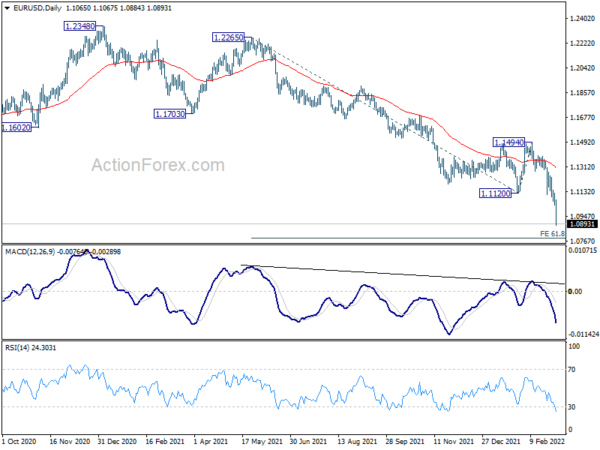

EUR/USD’s decline accelerates further to as low as 1.0888 and intraday bias remains on the downside. Current down trend should target 61.8% projection of 1.2265 to 1.1120 from 1.1494 at 1.0786 next. On the upside, above 1.1038 minor resistance will turn intraday bias neutral and bring consolidations first, before staging another decline.

In the bigger picture, the decline from 1.2348 (2021 high) is expected to continue as long as 1.1494 resistance holds. Firm break of 1.0635 (2020 low) will raise the chance of long term down trend resumption and target a retest on 1.0339 (2017 low) next. Nevertheless, break of 1.1494 will maintain medium term neutral outlook, and extend range trading first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Unemployment Rate Jan | 2.80% | 2.70% | 2.70% | |

| 07:00 | EUR | Germany Trade Balance (EUR) Jan | 9.4B | 7.5B | 6.8B | |

| 07:45 | EUR | France Industrial Output M/M Jan | 1.60% | 0.40% | -0.20% | -0.10% |

| 09:30 | GBP | Construction PMI Feb | 59.1 | 57.4 | 56.3 | |

| 10:00 | EUR | Eurozone Retail Sales M/M Jan | 0.20% | 1.50% | -3.00% | -2.70% |

| 13:30 | CAD | Building Permits M/M Jan | -8.80% | 0.10% | -1.90% | -2.40% |

| 13:30 | CAD | Labor Productivity Q/Q Q4 | -0.50% | -0.20% | -1.50% | -1.20% |

| 13:30 | USD | Nonfarm Payrolls Feb | 678K | 438K | 467K | 481K |

| 13:30 | USD | Unemployment Rate Feb | 3.80% | 3.90% | 4.00% | |

| 13:30 | USD | Average Hourly Earnings M/M Feb | 0.00% | 0.60% | 0.70% | 0.60% |

| 15:00 | CAD | Ivey PMI Feb | 54.2 | 57.4 |