Products You May Like

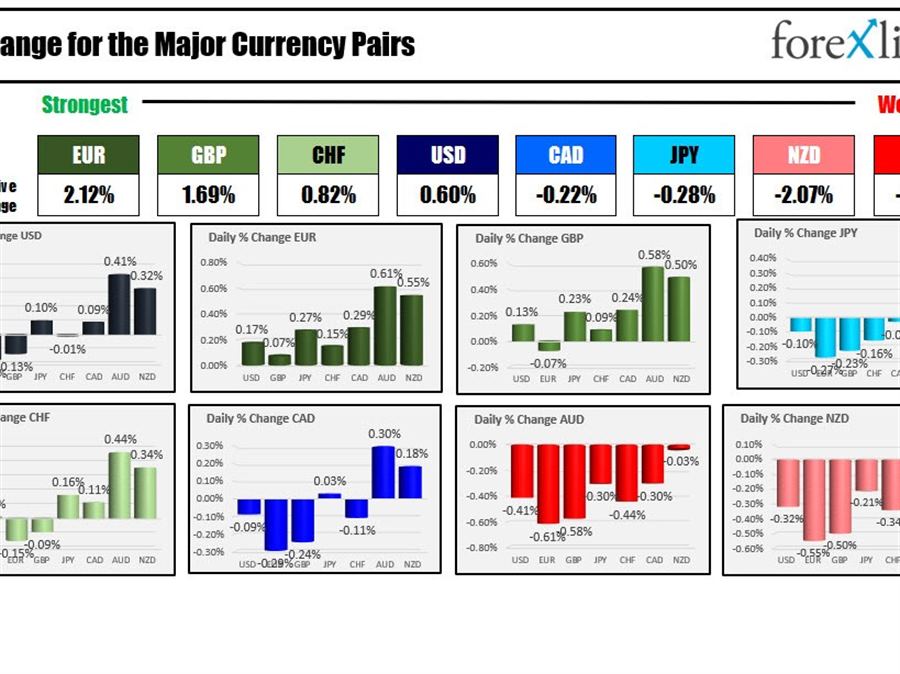

The EUR is the strongest and the and the AUD is the weakest as the North American session begins. The bond market has calmed down after first Brainard’s hawkish comments on Tuesday, and then the Fed minutes yesterday that indicated the Fed was closer to raise about 50 basis points at the last meeting, and and the finger on the trigger for tapering at the next meeting by some $95 billion ($60B for Treasury securities and $35B for MBS).

Meanwhile in China, lockdown has slowed their economy and that may lead to a easing of monetary policy. Shanghai remained under lockdown with a record 20,000 new infections reported despite the measures taken.

US stocks are mixed with the Dow down marginally and the NASDAQ up. The S&P is marginally higher.

US yields are mixed with the yield curve steepening up to 15 basis points in the 2 – 10 year spread. French issued a 10 year bond at 1.17% up from 0.52% last. French yields have been rising as Macron’s lead over Le Pen has narrowed. The 10 year spread between France and German yields has risen to as high as 55 basis points (currently at 53.6 basis points) from 40 basis points on March 30.

The Fedspeak will continue today with Feds Williams, Fed’s Evans and Feds Bostic oil scheduled to speak. It looks like Bullard may also be speaking today.

In Europe, German industrial production came in marginally higher at 0.2% versus 0.1% estimate. That is slower than the 1.4% in the prior month. EU retail sales came in weaker than expected 0.3% versus 0.6% estimate

The weekly initial claims data are expected to continue to show layoffs running near historically low levels at 200,000. The yield curve has yield curve has steepened trading. Canada budget will be released later this afternoon. Yesterday, it was reported that Canada will ban foreign purchases of property for 2 years.

A snapshot of the markets as North American traders enter for the day shows:

- Spot gold is trading up $7.30 or 0.38% at $1930.82

- Spot silver is trading up five cents or 0.17% at $24.47

- Spot crude oil is trading up to dollars and $0.38 or 2.46% at $98.58

- Bitcoin is trading at $43,705 up about $500 on the day

The major US stock indices down for 2 consecutive days, In the premarket today, the indices are mixed with the Dow down marginally, the NASDAQ higher and the S&P marginally higher.

- Dow industrial average down -35 points after yesterday’s -144.67 point decline

- S&P index up five points after yesterday’s -43.95 point decline

- NASDAQ index is up 45 points after yesterday’s -315.35 point decline

In the European equity markets, the major indices are rebounding. The UK FTSE is down marginally

- German DAX, up 0.5%

- France’s CAC, up 0.7%

- UK’s FTSE 100 down -0.1%

- Spain’s Ibex, up 1.2%

- Italy’s FTSE MIB up 1.0%

In the US debt market, US yields are mixed. The yield curve have seen a steepening of late. The 2-10 year spread is back up to 15 basis points after trading as inverted at -8.6 basis points just a few days ago.

In the European debt market, the benchmark 10 year yields are mostly higher