Products You May Like

The USDJPY is trading higher once again today and in the process has blown back through the June 2015 high at 125.86 and the high from Wednesday t 126.31. That move puts the price at the highest level since May 2002 nearly 20 years ago (see weekly chart above).

My USDJPY charts are running out of history. I have the May 6 week swing high up at 128.920 and that’s it (see chart above). There remains some room between the current price at 126.46 and that 128.92 high, but not much.

Driving the move higher is central bank rate policy.

The Fed is intent on a series of tightenings to get back to the neutral rate (at least) at around 2.50% (and may have to go higher). The Fed is expected to hike by 50 bps at the next meeting in March and the market is expecting another 50 bps in June (the current rate is 0.50%).

Meanwhile, the BOJ is happy to keep the status quo and in fact are looking to limit the moves in their yields.

That dynamic has led to a surge in yield spreads between the US and Japan debt instruments.

Looking at the 10 year yield spread below, the spread between US 10 year yields and Japan 10 year yields has widened to over 250 basis points from about 153 basis points on March 7. Note the yield spread basing against its 100 day moving average back in early March before moving to the upside.

Over the same period, the USDJPY has moved from around 114.82 to the high today of 126.68 or 1186 pips (10.32%). Also note how the USDJPY based against its 100 day moving average back in early March before moving to the upside.Those MAs do tend to give traders risk and bias defining clues.

Those are big moves.

However, with inflationary pressures still not fully resolved ( commodities are still relatively up there with oil back at $106 after trading at $93 on Monday, natural gas at highest level since 2008, corn at highs since 2012, wheat moving back higher and soybeans also elevated, etc), and employment at or near full employment levels, the fear is the trend has the possibility to continue (in spreads and in the USDJPY’s move).

When you trade at such extremes, it is hard to grasp on to targets on the topside(we are at highest levels since 2002 after all). However, where there’s a will there’s a way.

One tact that tends not to work – especially in a trending market – is to get suckered into the idea that “the market is way overbought, so the only trade is to sell”.

My response is been, “the markets have been overbought for a while, and all those traders who have sold are likely adding to the bullish bias today”.

The better tact for traders is to say, “The market is overbought, but sellers have to prove that they can take back control.”

How can they do that?

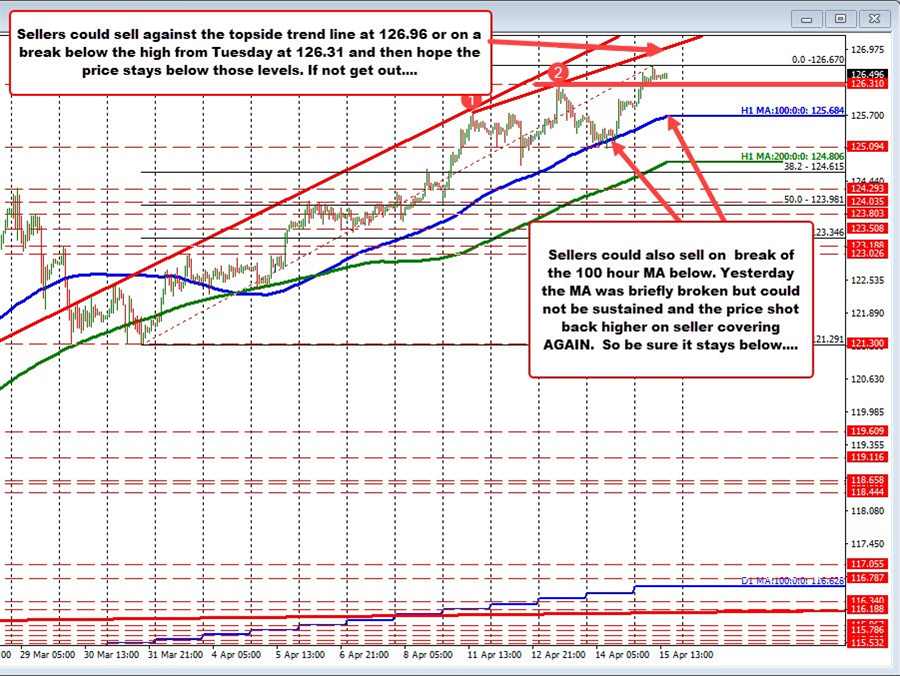

Looking at the hourly chart below, the price high from Wednesday’s trade reached 126.31. A move back below that level and staying below that level would give sellers a level to lean against. Sellers would prove they can win a battle by moving below that level and staying below (and targeting other lower levels).

Alternatively, the rising 100 hour moving average (blue line in the chart above) currently at 125.684 would be a another level to get to and through, and would increase the bearish bias in the process.

Yesterday, the price moved down to test that 100 hour moving average (see blue line in the chart above), and although the price did dip below the moving average line it was only by a few pips before the price rotated back to the upside. Sellers who sold below the level would likely cover on the move back above the moving average level when momentum started to increase (hence the fuel for more upside momentum).

Nevertheless, going forward moving below the 100 hour moving average and staying below would be indicative of potentially more corrective downside probing from the overbought conditions. That would be a way that sellers could prove they can take back more control.

What about the upside? Can traders target a level to lean against on a run further to an overbought level on the upside?

Looking at the hourly chart above, connecting the highs from the week on Monday and again on Wednesday, the upward sloping trendline cuts across currently at 126.96. That level is close to the 127.00 natural resistance level . Sellers looking to pick a top could lean against that level with stops on a break above. It is trading against the trend, but at least risk is defined and limited against two targets in the same area. Note however, that if the price moves above, get out. .

Trends are fast, directional, and tend to go farther than traders expect.

Also the most money is lost in trending markets.

So avoid trading against the trend unless you have real technical reasons i.e. like the reasons outlined above with risk defined.

Selling simply because the price high and “overbought” is not an option. Remember, overbought in a trending market becomes more overbought as the market continues to trend. That is what a trend move does…

Also, always keep that in mind you don’t have to sell. Instead try to get on the trend by buying against support. The buyers who leaned against the 100 hour MA near 125.15 yesterday are looking 126.48 today.