Products You May Like

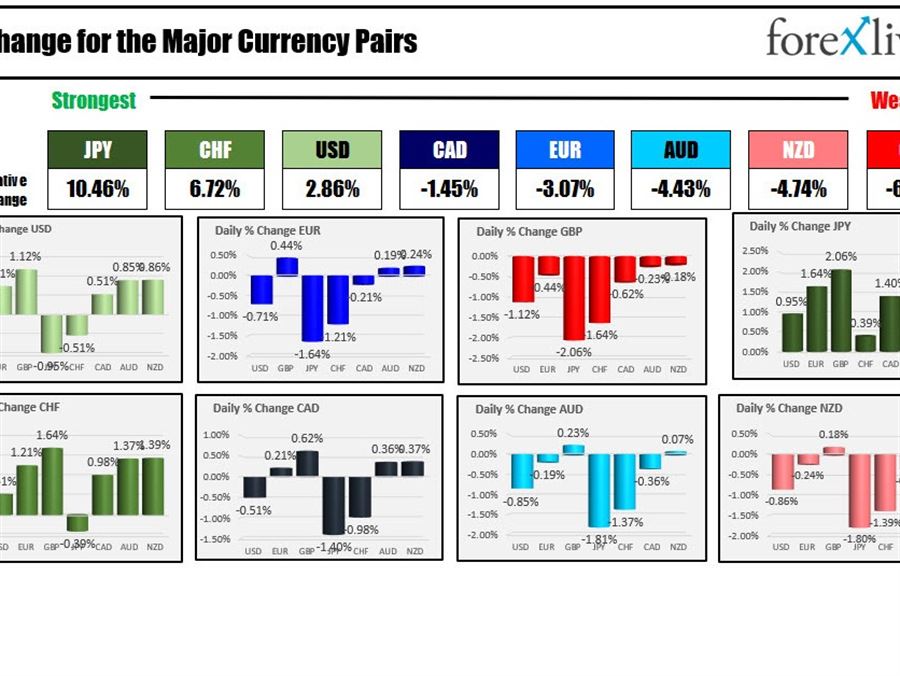

The USD is making new session highs vs the EUR, GBP, CAD, AUD and NZD. The JPY and the CHF meanwhile are attracting the most forex flows.

- USD: The EURUSD is back below its 200 hour MA and is also ticking below the low price going back to April 28 at 1.04709. The 100 hour moving average comes in at 1.04483 and is the next major target. Traders will not use the 200 hour moving average 1.04885 as close resistance.

- GBPUSD: The GBPUSD is trading at 1.23503. The move down from the high price at 1.2500 has also moved the price below a swing area from May 9 and May 11 at 1.2400 to 1.2410. Stay below that level is more bearish going forward. The 100 hour moving average is the next major downside target at 1.23207. The 200 hour moving average is below that at 1.2312. Move below both those levels and the sellers are in firm control

- USDCAD: The USDCAD has broken above a swing area that kept a lid on the pair between 1.2846 and 1.2859 both yesterday and today. The swing low from last Friday’s trade is the next target at 1.2888 (the current price is trading at 1.2879), and above that is the 100 hour moving average at 1.28984. On the downside, close risk is now 1.2859.

- AUDUSD: The AUDUSD is trading to a new session low of 0.69595. That takes the price just below the 200 hour moving average at 0.69605. The 100 hour moving average cuts across at 0.6953. That is another downside targets on further selling. Move below each of those levels and the sellers are in firm control. Find buyers against this level and a move back above the 38.2% retracement of the May trading range at 0.69954 would be the upside target..

- NZDUSD: The NZDUSD is testing its 100 hour moving average at 0.69988. The low price just reached 0.6296 just below that level. The 200 hour moving average has already been broken and 0.63098. Traders want to see further momentum below the moving average levels to increase the bearish bias. Conversely a failed break below levels would have traders looking back toward the 0.63317 which was a swing low during yesterday’s New York afternoon session.

This article was originally published by Forexlive.com. Read the original article here.