Products You May Like

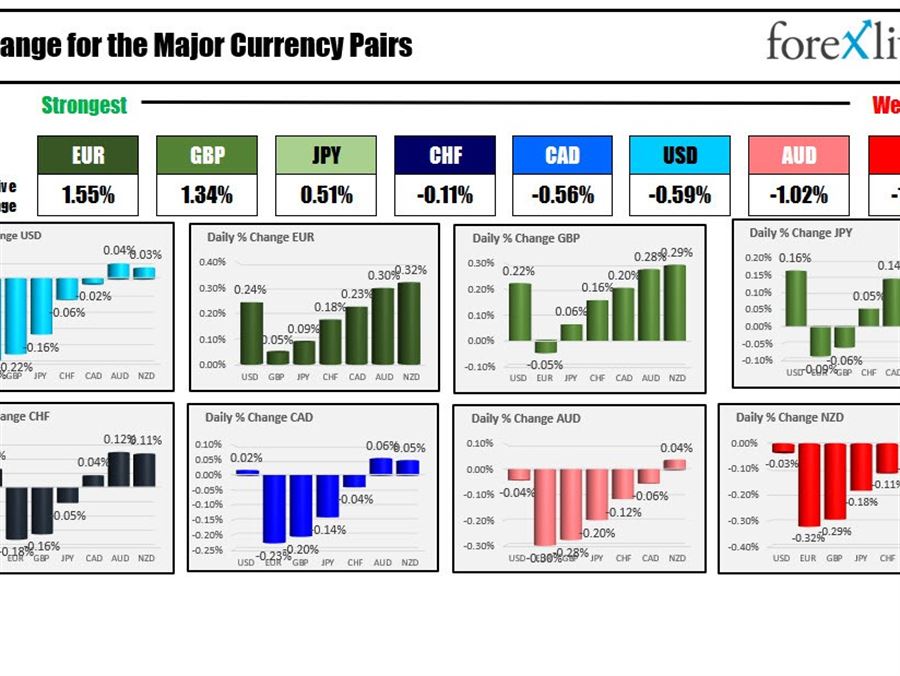

The EUR is the strongest and the NZD is the weakest as the NA session begins. The USD is mixed to lower with modest gains vs the AUD and NZD and bigger declines vs the EUR, GBP and JPY (although the changes are still relatively modest and there has been more up and down activity today).

The US major stock indices are higher in pre-market trading (and off earlier premarket lows) although both Nvidia and Apple are lower. Nvidia is lower as they guided lower largely as a result of China/Russia concerns. Apple also announced that it expects to ship less iPhones this year vs expectations (220M vs 240M est). Nvidia shares are trading down -4.12% while Apple is down -1.17%. Nvidia was down over -7% shortly after the release of earnings.

The FOMC meeting minutes released late yesterday and from the May meeting said

- Fed should expeditiously move monetary policy toward a more neutral stance

- A restrictive policy may become appropriate

- Officials emphasize that they were highly attentive to inflation risks which were skewed to the upside

- Price pressures remain elevated and it was too early to be confident that inflation at peak

The details from the minutes added:

- The US economy was very strong with the labor market extremely tight and inflation very high

- Members all Ukraine conflict and China Covid lockdowns posing heightened risks

- Most officials backed 50 basis point rate hikes at the next couple of meetings

A look around the markets shows:

- Spot gold is trading down $-7.23 -0.4% at $1845.25

- Spot silver is down $-0.09 -0.42% $21.85

- WTI crude oil is trading up $0.66 at $111

- Bitcoin is trading lower at $29,005

A snapshot of the US stock market from the perspective of the futures market shows the major indices higher led by the Dow and S&P. All the major indices rose yesterday and are now higher for the week. The S&P and NASDAQ have been down for 7 consecutive weeks. The down vessel average down for a consecutive weeks

- Dow is up 192.72 points after yesterdays 191.66 point rise

- S&P index is up 23.62 points after yesterdays 37.25 point rise

- NASDAQ index is up 27.32 points after yesterdays 170.29 point rise

In Europe: the major indices are trading higher

- German DAX is up 109 points or 0.78% at 14117.05

- France’s CAC is up 43.16 points or 0.68% at 6341.41

- UK’s FTSE 100 is up 7 points or 0.09% at 7526.72

- Spain’s Ibex is up 76.5 points or 0.87% at 8835.99

The US debt market this morning, yields are mixed with a steeper yield curve

In the European debt market the benchmark 10 year yields are mostly higher