Products You May Like

Commodity currencies remain in the driving seat for the week, with Aussie having a slight upper hand over Loonie. Both are supported by firmer risk sentiments, as well as expectations for more tightening. Yen is the runaway loser for the week and looks set to resume broad based down trend. Dollar is mixed for now, a little on the soft side, in reaction to risk sentiment. Focus will turn to non-farm payroll report today, and the reaction in the stock markets would be the main driver in FX.

Technically, CAD/JPY’s break of 102.93 resistance confirms up trend resumption. Next target is 61.8% projection of 89.21 to 102.93 from 97.78 at 106.25. AUD/JPY is also making some progress by breaking 94.00 resistance. Focus will turn to 95.73 high in AUD/JPY and break will confirm up trend resumption too. Such developments, if happen, should be accompanied by extended rebound in stocks, and probably treasury yields too.

In Asia, Nikkei closed up 1.19%. Hong Kong and China are on holiday. Singapore Strait Times is up 0.13%. Japan 10-year JGB yield is down -0.0076 at 0.238. Overnight, DOW rose 1.33%. S&P 500 rose 1.84%. NADSAQ rose 2.69%. 10-year yield dropped -0.0018 to 2.913.

Fed Mester cannot conclude inflation has peaked

Cleveland Fed President Loretta Mester said yesterday, “if by the September FOMC meeting, the monthly readings on inflation provide compelling evidence that inflation is moving down, then the pace of rate increases could slow. But if inflation has failed to moderate, then a faster pace of rate increases could be necessary.”

“I will need to see several months of sustained downward monthly readings of inflation. I have not seen that yet,” she said, thus she could not conclude that inflation has peaked.

On the economy, Mester said, “the risk of recession has risen, but because underlying aggregate demand momentum and the demand for labor are so strong, a good case can still be made that as demand and supply come into better balance, a sharp slowdown can be avoided, with growth slowing to a trend pace this year, labor market conditions remaining healthy, and inflation moving down to a 4‑1/2 to 5‑1/2 percent range this year and declining further next year,” Mester said.

Fed Brainard: It’s very hard to see the case for pause in Sep

Fed Vice Chair Lael Brainard told CNBC yesterday, “right now, it’s very hard to see the case for a pause… We’ve still got a lot of work to do to get inflation down to our 2% target.” Atlanta Fed President Raphael Bostic noted earlier that a pause in September might make sense to see how the economy evolves after successive rate hikes.

“We’re certainly going to do what is necessary to bring inflation back down,” Brainard said. “That’s our No. 1 challenge right now. We are starting from a position of strength. The economy has a lot of momentum.”

BoC Beaudry: Interest rate may need to go above 3%

BoC Deputy Governor Paul Beaudry said in a speech, “we noted that price pressures are broadening and inflation is much higher than we expected and likely to go higher still before easing.”

“This raises the likelihood that we may need to raise the policy rate to the top end or above the neutral range to bring demand and supply into balance and keep inflation expectations well anchored,” he added.

Beaudry also indicated that the neutral range, a rate that “neither stimulates nor weighs on growth”, is estimated to be “between 2% and 3%”

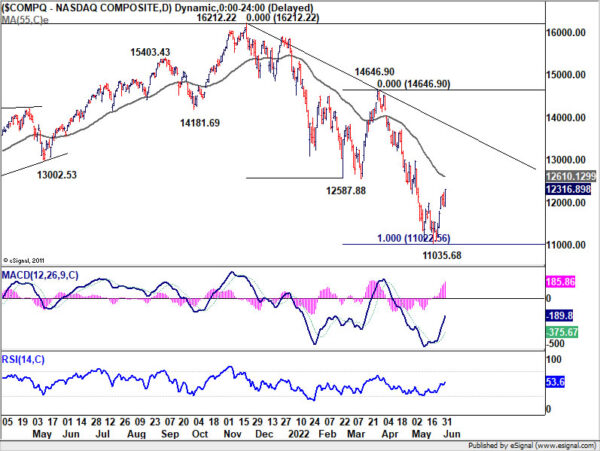

NASDAQ extends rebound as focus turns to NFP

US non-farm payroll employment is the main focus for today. The US economy is expected to add 325k jobs in May. Unemployment rate is expected to drop from 3.6% to 3.5%. Average hourly earnings are expected to rise another 0.4% mom. Looking at related data, ADP private jobs grew just 128k, well below expectations. ISM manufacturing employment dropped into contraction reading of 49.6. Four-week moving average of initial claims also rose notably from 188k to 206k. There is risk of downside surprise in the heading NFP number today. But wages growth would be the one that matters more.

US stocks are trying to extend rebound this week, even though some Fed officials tried to talk down the prospect of a September pause in tightening. NASDAQ’s rebound form 11035.68 is in progress for 55 day EMA (now at 12610.13). Sustained break there will raise the chance that whole fall from 16212.22 has completed in form of a three wave correction. Stronger rally would then be seen back towards trendline resistance at around 13800 later in the month. Such development would cap rally attempts in the greenback.

Elsewhere

Australia AiG Performance of Construction dropped sharply from 55.9 to 50.4 in may. Germany trade balance and France industrial output will be released in European session. Eurozone will release PMI services final and retail sales. Later in the day, in addition to NFP, US will also publish ISM services.

AUD/USD Daily Report

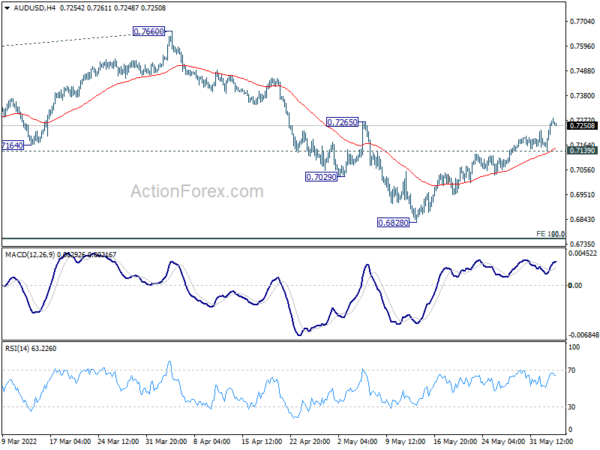

Daily Pivots: (S1) 0.7181; (P) 0.7226; (R1) 0.7310; More…

AUD/USD’s rebound from 0.6828 extends further and intraday bias stays on the upside. Breach of 0.7265 resistance is a sign that whole corrective fall from 0.8006 has completed with three waves down to 0.6828. Further rise should be seen back to 0.7660 resistance next. On the downside, however, break of 0.7139 minor support will mix up the outlook and turn intraday bias neutral first.

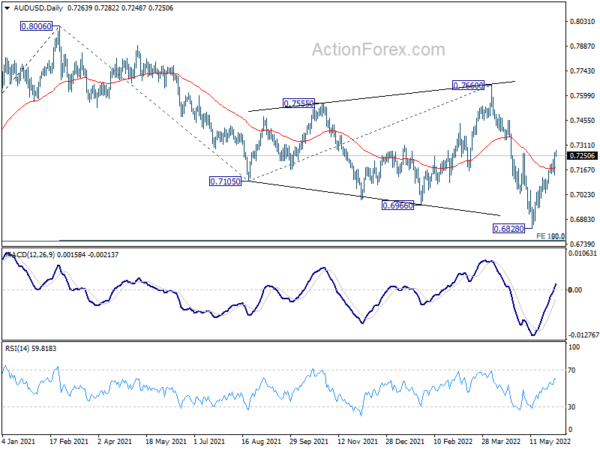

In the bigger picture, price actions from 0.8006 are seen as a corrective pattern to rise from 0.5506 (2020 low). Deeper fall could be seen to 50% retracement of 0.5506 to 0.8006 at 0.6756. This coincides with 100% projection of 0.8006 to 0.7105 from 0.7660 at 0.6760. Strong support is expected from 0.6756/60 cluster to contain downside to complete the correction. Meanwhile, firm break of 0.7660 resistance will confirm that such corrective pattern has completed, and larger up trend is ready to resume.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Construction Index May | 50.4 | 55.9 | ||

| 06:00 | EUR | Germany Trade Balance (EUR) Apr | 5.6B | 3.2B | ||

| 06:45 | EUR | France Industrial Output M/M Apr | 0.40% | -0.50% | ||

| 07:45 | EUR | Italy Services PMI May | 54.5 | 55.7 | ||

| 07:50 | EUR | France Services PMI May F | 58.4 | 58.4 | ||

| 07:55 | EUR | Germany Services PMI May F | 56.3 | 56.3 | ||

| 08:00 | EUR | Eurozone Services PMI May F | 56.3 | 56.3 | ||

| 09:00 | EUR | Eurozone Retail Sales M/M Apr | 0.30% | -0.40% | ||

| 12:30 | CAD | Labor Productivity Q/Q Q1 | -1.20% | -0.50% | ||

| 12:30 | USD | Nonfarm Payrolls May | 325K | 428K | ||

| 12:30 | USD | Unemployment Rate May | 3.50% | 3.60% | ||

| 12:30 | USD | Average Hourly Earnings M/M May | 0.40% | 0.30% | ||

| 13:45 | USD | Services PMI May F | 53.5 | 53.5 | ||

| 14:00 | USD | ISM Services PMI May | 56.7 | 57.1 |