Products You May Like

Overall, the forex markets are pretty much staying in range, except for a few. Aussie and Kiwi are the weaker ones for the week, as weighed down by negative sentiment, as well as falling commodity prices But Dollar isn’t too far behind, following the pull back in treasury yields. Swiss Franc and Sterling are the relatively stronger ones, together with Euro. Gold is trading in range while oil price is gyrating lower. Stocks lack committed buying for a sustainable rebound.

Technically, EUR/CHF is extending recent fall from 1.0512 but there is no follow through selling yet. Near term outlook is bearish for retesting 0.9970 low. But break of 1.0214 resistance will bring another rebound to the sideway pattern from 0.9970. The next move in EUR/CHF could be indicative to what next for EUR/USD and EUR/GBP.

In Asia, at the time of writing, Nikkei is up 1.10%. Hong Kong HSI is up 1.64%. China Shanghai SSE is up 0.58%. Singapore Strait Times is up 0.33%. Japan 10-year JGB yield is down -0.0046 at 0.231. Overnight, DOW rose 0.64%. S&P 500 rose 0.95%. NASDAQ rose 1.62%. 10-year yield dropped -0.088 to 3.068.

Japan CPI core unchanged at 2.1% yoy, above target for second month

Japan CPI core (all item ex-fresh food) was unchanged at 2.1% yoy in May, matched expectations. That’s the second month that core consumer inflation tops BoJ’s 2% target. All item CPI was unchanged at 2.5% yoy, below expectation of 2.9% yoy. CPI core-core (all item ex-food, energy) was unchanged at 0.8% yoy, above expectation of 0.4% yoy.

But Deputy Chief Cabinet Secretary Seiji Kihara warned in the press conference, “we think it is necessary to pay close attention to the downside risks of the economy such as pushing down private consumption and corporate activities.”

UK Gfk consumer confidence dropped to -41 in Jun, another record low

UK Gfk consumer confidence dropped from -40 to -41 in June, matched expectations, and set a new record low. Personal financial situation over the next 12 months dropped from -25 to -28. General economic situation for the next 12 months dropped from -56 to -57.

Joe Staton, Client Strategy Director, GfK says: “With a headline score of -41 for June, the GfK Consumer Confidence Barometer has set a record low for the second successive month…. The consumer mood is currently darker than in the early stages of the Covid pandemic, the result of the 2016 Brexit referendum, and even the shock of the 2008 global financial crisis, and now there’s talk of a looming recession.”

Looking ahead

UK retail sales and Germany Ifo business climate are the major focuses in European session. Later in the day, US will release new home sales.

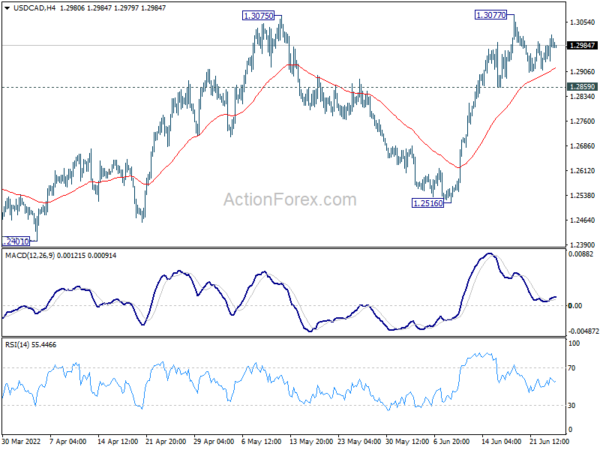

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2949; (P) 1.2984; (R1) 1.3030; More…

Intraday bias in USD/CAD remains neutral for consolidation below 1.3077. With 1.2859 minor support intact, further rise remains in favor. On the upside, break of 1.3077 and sustained trading above 1.3022 fibonacci level will carry larger bullish implications. Next target is 100% projection of 1.2005 to 1.2947 from 1.2401 at 1.3343.

In the bigger picture, focus stays on 38.2% retracement of 1.4667 (2020 high) to 1.2005 (2021 low) at 1.3022. Sustained break there should confirm that the down trend from 1.4667 has completed after defending 1.2061 long term cluster support. Further rise would then be seen towards 61.8% retracement at 1.3650. However, rejection by 1.3022 will maintain medium term bearishness.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | GfK Consumer Confidence Jun | -41 | -41 | -40 | |

| 23:30 | JPY | National CPI Core Y/Y May | 2.10% | 2.10% | 2.10% | |

| 23:50 | JPY | Corporate Service Price Index Y/Y May | 1.80% | 1.50% | 1.70% | |

| 06:00 | GBP | Retail Sales M/M May | -0.90% | 1.40% | ||

| 06:00 | GBP | Retail Sales Y/Y May | 4.30% | -4.90% | ||

| 06:00 | GBP | Retail Sales ex-Fuel M/M May | -1.40% | 1.40% | ||

| 06:00 | GBP | Retail Sales ex-Fuel Y/Y May | 4.70% | -6.10% | ||

| 08:00 | EUR | Germany IFO Business Climate Jun | 92.9 | 93 | ||

| 08:00 | EUR | Germany IFO Current Assessment Jun | 99 | 99.5 | ||

| 08:00 | EUR | Germany IFO Expectations Jun | 87.4 | 86.9 | ||

| 14:00 | USD | New Home Sales May | 605K | 591K | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Jun F | 50.2 | 50.2 |