Products You May Like

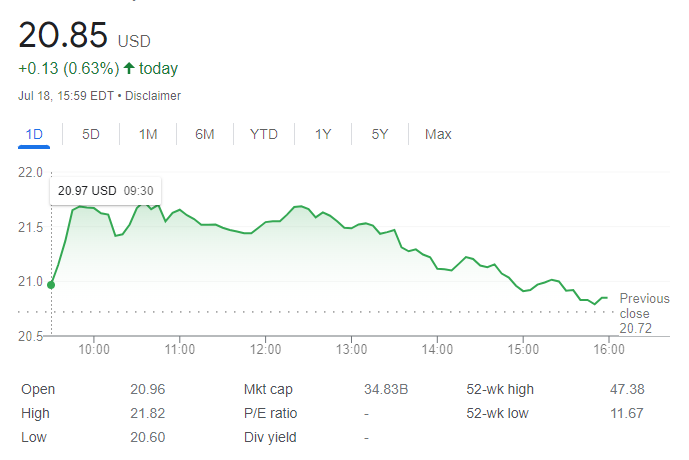

- NYSE:NIO ends Monday barely up above $20.00 per share.

- AliBaba executives were questioned regarding a cyber security breach.

- BYD stock tumbles on fears that Warren Buffett is selling his stake in the EV maker.

Update: NIO share trimmed early gains and finished Monday at $20.85, barely 0.63% up on the week’s first trading day. Wall Street rallied ahead of the opening as investors welcomed upbeat US data released on Friday but closed the day in the red. The Dow Jones Industrial Average lost 216 points, while the Nasdaq Composite finished the day 0.81% lower. The S&P 500 lost roughly 1%, as optimism was short-lived. Market players are waiting for central banks’ monetary policy announcements, the European Central Bank is scheduled for this week, while the US Federal Reserve for the next one. Investors are concerned about the slower economic performance and constant price pressures, the latter indifferent to aggressive quantitative tightening.

Previous update: NIO shares advanced 4.4% to $21.63 on Monday morning after a general risk-on mood embraced markets. Bitcoin advanced more than 7%, which acts as a sort of risk barometer in markets. More than 8,000 call contracts expiring this Friday were purchased in the first hour at the $21, $21.50 and $22 strike prices. Premiums on the three strikes jumped 59% or more from Friday’s prices as buyers make an optimistic bet on Nio’s short-term price movement.

NYSE:NIO dipped lower to close the week as renewed crackdowns on Chinese tech companies sent ADR stocks tumbling into the weekend. On Friday, shares of Nio fell by 1.57% and closed the trading week at $20.72. Stocks soared higher on Friday as investors shrugged off the record CPI report from June and a mixed start to Wall Street earnings season. Overall, the Dow Jones jumped higher by 658 basis points, the S&P 500 rose by 1.92%, and the NASDAQ posted a 1.79% during the session.

Stay up to speed with hot stocks’ news!

Chinese stocks were trading lower in both the American and Asian trading sessions on Friday. AliBaba (NYSE:BABA) executives were being questioned by Chinese authorities on the country’s largest known cyber security breach. In other news, Tencent has also been forced to close down one of its NFT Marketplace sites, due to not complying with government regulations. It’s a reminder to investors that regulation will continue to have an effect on these businesses into the future, and that ADR stocks like Nio and AliBaba could fall further before turning things around.

NIO stock forecast

Nio-rival and Chinese electric vehicle market leader, BYD, saw its share price tumble earlier this week. The fear is over belief that Warren Buffett might be pulling out his stake in the company, which is equivalent to about 20% of the outstanding shares in Hong Kong. The reason for the fear is that there is an order for 225 million shares of BYD in the Hong Kong Stock Exchange clearing system. This matches Buffett’s position, although neither Berkshire Hathaway or BYD have commented on the matter.

Like this article? Help us with some feedback by answering this survey: