Products You May Like

The ECB hiked by a higher than expected 50 basis points which helped to temporarily propel the EUR to the top of the league table of the strongest to weakest of the major currencies.

However, momentum could be sustained. ECBs Lagarde said that although the rate rise was a greater than expected 50 basis points, it did not necessarily mean the ECB would ramp up rates above expectations. The expectations are for 125 basis points in 2022.

The ECB also announced that they would activate the Transmission Protection Instrument or TPI (they love their acronyms) whose intentions is to keep EU country rates tethered to each other within the Eurozone.

It sounds all good and fine, but there are a number of fuzzy decision steps that would make implementation largely subjective, not to mention gives government a free option (i.e. the ECB will come to the rescue). You can read more by clicking here.

Other headwinds came technically when the price spike stalled short of the 50% midpoint target at 1.02829. The high from yesterday at 1.0272 was broken, but the pair could not go the full 10 pips more and extend above that midpoint topside target. The high reached 1.02773. Seller leaned, the buyers gave up and a new low was made before a modest rally into the close.

Having said, the the EURUSD did rally at the end of day, and that pushed the price back into positive territory for the day and away from it’s 100 hour MA at 1.0181. That level will be a key barometer in the new trading day. Stay above and the 50% may be revisited in the new trading day. Move below and buyers turn to sellers.

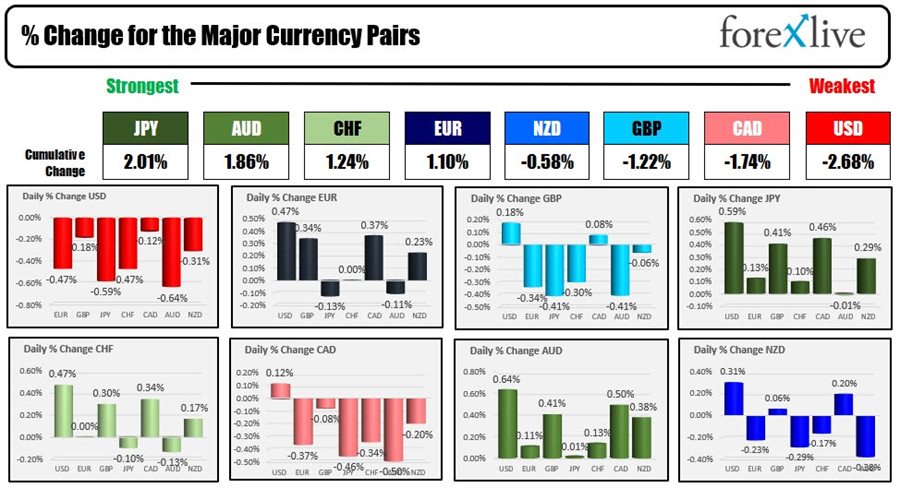

The USD is ending the day lower vs the EUR (lower yields are helping), but is also trading to lows vs all the other major currencies. In fact, the USD is ending as the weakest of the majors while the JPY is the strongest.

The USDJPY is trading to new session lows into the close helped by a technical break of the 200 hour MA at 137.975. The pair is trading at 137.35. The break is the first on the hourly chart since July 8th

The USDCHF is also making a new extreme low (lower dollar) in the last hour. For that pair, the highs for the day found sellers agains the 100 hour MA near 0.9735. The pair is trading at session lows at 0.9665 near the end of NY session.

The AUD and the NZD are other pairs making new highs vs the greenback. The AUDUSD is trading to the highest level since June 28. The NZDUSD fell earlier in the day after disappointing trade data, but recovered all the declines and then some by the close. The pairs is trading at 0.6252 with the high from yesterday at 0.6270 as the next target.

In other market into the close:

- Spot gold is trading up $23 or 1.36% at $1719.60

- Spot silver is up $0.24 or 1.28% at $18.87

- Crude oil is trading down -$3.44 or -3.44% at $96.44

- Bitcoin is lower on the day, trading at $23176 but off the low at $22340.

In the US stock market, the Nasdaq continued its run to the upside (up 5 of 6 trading days. The Dow and S&P also moved higher.

- Dow rose 162.06 points or 0.51% at 32036.91

- S&P rose 39.05 points or 0.99% at 3998.94

- Nasdaq rose 161.97 or 1.36% at 12059.62

- Russell 2000 rose 8.74 points or 0.48% at 1836.69

IN the US debt market, yields fell sharply into the close for the day:

- 2 year 3.093%, down -13.6 basis points

- 5 year 2.986%, down -17.9 basis points

- 10 year 3.877%, down -15 basis points

- 30 year 3.043%, down -11.7 basis points.