Products You May Like

- Gold price re-attempts $1,700 amid a dead cat bounce, pre-NFP caution.

- Aggressive global tightening bets, China covid lockdowns keep investors on the edge.

- XAU/USD closed Thursday below $1,700, bears target $1,681 and $1,677.

Gold price is attempting a dead cat bounce from six-week lows of $1,689, as investors reposition in the run-up to the critical US Nonfarm Payrolls release. Gold traders refrain from placing any directional bets, as the US payrolls data will likely have a significant impact on the Fed’s rate hike pricing for this month. Heading into the US jobs report, markets are wagering a 74% probability of a 75 bps September rate hike. With the US economy expected to have added 300K jobs in August, the dollar remains in a win-win position, as hawkish Fed rate hike expectations and China’s fresh covid lockdown in Chengdu-led risk-aversion will continue favoring the dollar bulls. The bright metal, therefore, remains at risk of further decline should the recovery attempt fade. The US Treasury yields hovering near multi-year highs will also keep any rebound in the bullion checked.

Also read: US August Nonfarm Payrolls Preview: Analyzing gold’s reaction to NFP surprises

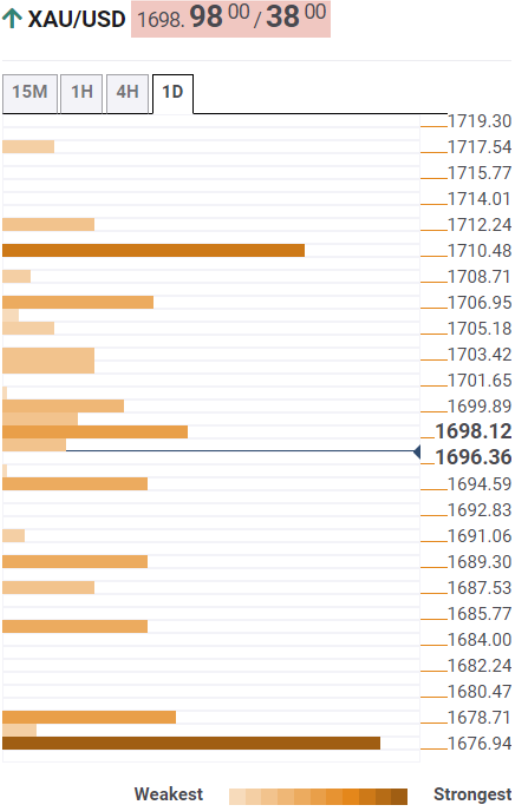

Gold Price: Key levels to watch

The Technical Confluence Detector shows that the gold price needs to find acceptance above the Fibonacci 61.8% one-day at $1,703 to extend the recovery towards the pivot point one-week S2 at $1,707.

The next powerful resistance for bulls is seen around $1,710, where the pivot point one-day R1 and the previous month’s low coincide.

If the downside resumes momentum, then bears will aim for the immediate cap at $1,694, the Fibonacci 23.6% one-day.

Further south, the confluence of the previous day’s low and the pivot point one-day S1 around $1,688 will be challenged.

The 2022 lows of $1,681 will be next on sellers’ radars, below which a test of the 2021 low of $1,677 will be on the table.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.