Products You May Like

The ECB raised rates by 75 basis points which was semi expected. In doing so, the ECB raise projections for inflation (see 5.5% in 2023 now vs 3.5%), lowered growth for 2023 (seee 0.9% vs 2.1%), and 2024 (see 1.9% vs 2.1%) while raising growth for 2022. The ECB’s Lagarde said that 75 bps was not the norm, but policy was dependent on data and on a meeting by meeting basis. She also said that

- Risks to inflation tilted to the upside, risks to growth to the downside

- initial size of inflation expectations above target warrants monitoring

The EURUSD moved marginally higher peaking at a swing area between 1.0022 and 1.00328, but rotated back to the downside soon thereafter. Later when the traditional ECB sources comments were released that said 75 basis points should be considered at the next meeting, the EURUSD move to its lows of the day at 0.99299 (fell from around the 1.000 level). There was large expirations of options at the 1.0000 level, which may have contributed to the sharp decline as well.

However the pair ended up rebounding, and once the price moved above the 200 hour moving average at 0.99721, sellers turned the buyers later in the afternoon with the price moving back toward the parity level. The day is closing near 0.9998, which is down modestly from the 1.0006 close level from yesterday level.

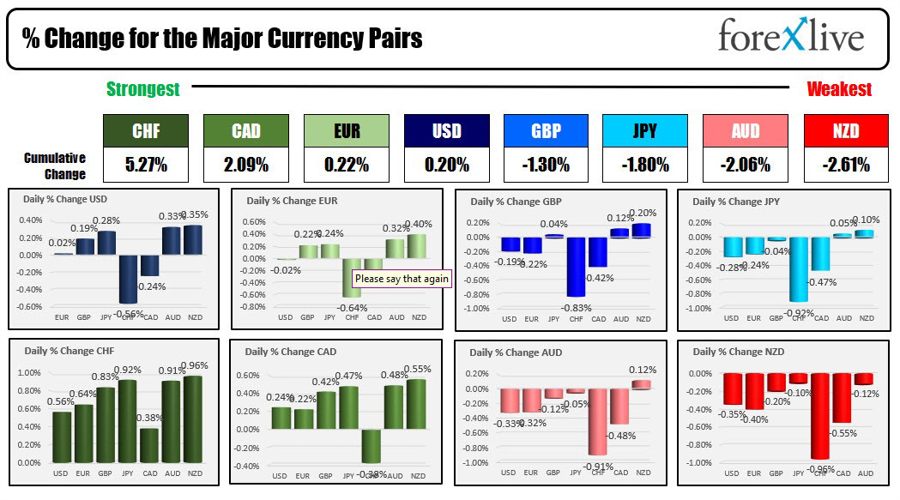

Looking at the strongest to weakest of the major currencies , the CHF is ending the day as the strongest of the major currencies while the NZD and AUD battle it out for the weakest.

The strongest to weakest of the major currencies

S&P’s Jordan spoke about maintaining price stability over the medium-term. He also said that exchange rates play a role in Swiss inflation and that went big central banks act, it helps us. The EURCHF is trading near its lowest levels since early 2015. The price is closing today below the January 2015 low at 0.97065. The price is currently at 0.9700. The USDCHF is is not near its lows for the year which were reached in early January, but it has moved back lower over the last 2 trading days, and tests its 100 day moving average near 0.9692. It is also well off its highs for the year near 1.0063.

Fed’s Powell also spoke in a lengthy 45 minute interview with Cato Institute. He reiterated a lot of his comments from the Jackson Hole 8 minute speech, saying that the Fed needs to keep going until it gets the job done on inflation. In a shift from central bank rhetoric he also said that we hope to usher in a period of below trend growth and with it get labor markets back into balance. On inflation expectations, a key concern for Fed officials, the Fed chair said that today they are well anchored over the long-term, but the clock is ticking and the Fed has more concerns that the public will incorporate higher inflation expectations in the short-term.

Unlike in the Jackson Hole speech, stocks held in despite the Fed chairs comments. The major indices all close higher for the 2nd consecutive day with modest gains of around 0.6%.

In other markets today:

- spot gold fell $9 or -0.54% at $1708.63

- spot silver rose $0.10 or 0.53% $18.53

- crude oil rebounded modestly to $82.61 that’s up around $0.60 on the day. The weekly crude oil inventories showed a surprise build of 8.844 million vs. expectations of a small draw of -0.25 million. Gasoline stocks increase by 0.333M vs. expectations of a drawdown of -1.667M

- the price bitcoin is trading modestly higher at $19,376

In the US debt market, yields were higher across the board:

- 2 year 3.51%, +7.3 basis points

- 5 year 3.424%, +6.4 basis points

- 10 year 3.319%, +5.2 basis points

- 30 year 3.478%, +6.4 basis points

Tomorrow, Canada will release their jobs report. Next Tuesday the US CPI report will be released.

In said news, Queen Elizabeth died at the age of 96 years old. Prince Charles will assume the role of monarch becoming King Charles III. Rest in peace.