Products You May Like

Sterling is in free fall today as markets reacted negatively to the “mini-budget” of the new government. Selloff came after Finance Minister Kwasi Kwarteng announced to cancel and planned rise in corporation tax, reverse a recent rise in income tax, and cut taxes for businesses in designated investment zones. Swiss Franc is currently the biggest winner for the day, followed by Dollar.

In Europe, at the time of writing, FTSE is down -1.84%. DAX is down -1.47%. CAC is down -1.61%. Germany 10-year yield is up 0.0182 at 1.986. Earlier in Asia, Hong Kong HSI dropped -1.18%. China Shanghai SSE dropped -0.66%. Singapore Strait Times dropped -1.10%. Japan was on holiday.

Canada retail sales down -2.5% mom in Jul

Canada retail sales dropped -2.5% mom to CAD 61.3B in July, worse than expectation of -2.0% mom. That’s also the first decline in seven months. Sales were down in 9 of 11 subsectors, representing 94.5% of retail trade. The contraction was driven by lower sales at gasoline stations and clothing and clothing accessories stores. Excluding gasoline, and motor vehicle and parts, sales dropped -0.9%.

Based on advance estimate, sales recovered by rising 0.4% mom in August.

Eurozone PMI composite dropped to 48.2, recession on the cards

Eurozone PMI manufacturing dropped from 49.6 to 48.5 in September, a 27-month low. PMI services dropped form 49.8 to 48.9, a 19-month low. PMI composite dropped from 48.9 to 48.2, a 20-month low.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said: “A eurozone recession is on the cards as companies report worsening business conditions and intensifying price pressures linked to soaring energy costs.

“The early PMI readings indicate an economic contraction of 0.1% in the third quarter, with the rate of decline having accelerated through the three months to September to signal the worst economic performance since 2013, excluding pandemic lockdown months.”

Germany PMI Manufacturing dropped from 48.3 to 49.1 in September, a 27-month low. PMI Services dropped from 47.7 to 45.4, a 28-month low. PMI Composite dropped from 46.9 to 45.9, a 28-month low.

France PMI Manufacturing dropped from 50.6 to 47.8 in August, a 28-month low. PMI Services improved from 51.2 to 53.0. Overall, PMI Composite rose from 50.4 to 51.2.

UK PMI composite dropped to 48.4, economic woes deepened

UK PMI manufacturing improved from 47.3 to 48.5 in September. But PMI services dropped from 50.9 to 49.2, a 20-month low. PMI Composite dropped from 49.6 to 48.4, a 20-month low.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

“UK economic woes deepened in September as falling business activity indicates that the economy is likely in recession. Companies report that the rising cost of living, linked to the energy crisis, and growing concerns about the outlook are subduing demand and hitting output levels to an extent not seen since 2009, barring the pandemic lockdowns and initial 2016 Brexit referendum shock.

“Forward-looking indicators meanwhile deteriorated further in September. Both the new orders and future expectations gauges have descended to levels which have rarely been weaker in the past, and are consistent with a deepening downturn as we head into the fourth quarter.

“Inflationary pressures continue to run higher than at any time in over two decades of survey history prior to the pandemic. Renewed supply constraints, soaring energy prices and rising import costs associated with the weakened pound are adding to cost pressures, meaning the overall rate of inflation signalled will remain of great concern to policymakers at the Bank of England. However, the detrimental impact of tightening policy into a recession is becoming increasingly apparent, with the downturn likely to intensify as we head into winter.”

UK Gfk consumer confidence dropped to new record low at -49

UK Gfk consumer confidence dropped further from -44 to -49 in September, hitting another record low since 1974. Personal financial situation over next 12 months dropped -9 pts to -40. General economic situation over next 12 months dropped -8 pts to -68. Major purchase index was unchanged at -38.

“Consumers are buckling under the pressure of the UK’s growing cost-of-living crisis driven by rapidly rising food prices, domestic fuel bills and mortgage payments. They are asking themselves when and how the situation will improve.” Joe Staton, client strategy director at GfK, said.

Australia PMI composite edged up to 50.8, at risk of heading into contraction territory

Australia PMI Manufacturing ticked up from 53.8 to 53.9 in September. PI Services also rose slightly from 50.2 to 50.4. PMI Composite Output rose from 50.2 to 50.8.

Laura Denman, Economist at S&P Global Market Intelligence said: “September data indicated that the recent interest rate hikes made by the RBA have begun to have the desired effect in terms of prices…. At the same time, the private sector has remained in expansion territory with the pace of growth even accelerating very slightly…

“On the negative side, the full effects of recent interest rate hikes will be lagged… Should the RBA continue to increase the base rate further, the private sector economy may be at risk of heading into contraction territory in the future as disposable incomes across the nation tighten and overall demand conditions remain subdued.”

GBP/USD Mid-Day Outlook

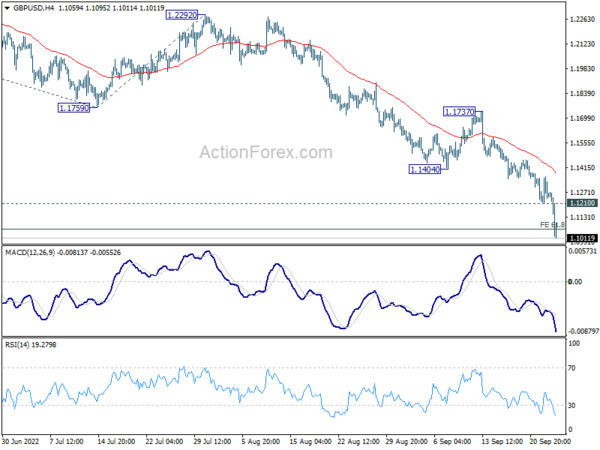

Daily Pivots: (S1) 1.1190; (P) 1.1277; (R1) 1.1342; More…

GBP/USD dives to as low as 1.1019 so far, meeting 61.8% projection of 1.3748 to 1.1759 from 1.2292 at 1.1063. there is no sign of bottoming yet. Intraday bias stays on the downside for 100% projection at 1.0303. On the upside, above 1.1210 minor resistance will turn intraday bias neutral and bring consolidations first, before staging another decline.

In the bigger picture, based on current momentum, fall from 1.4248 (2018 high) is probably resuming long term down trend from 2.1161 (2007 high). Sustained break of 1.1409 will target 61.8% projection of 1.7190 (2014 high) to 1.1409 (2020 low) from 1.4248 (2021 high) at 1.0675. This will remain the favored case for now as long as 1.2292 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:00 | AUD | Manufacturing PMI Sep P | 53.9 | 53.8 | ||

| 23:00 | AUD | Services PMI Sep P | 50.4 | 50.2 | ||

| 23:01 | GBP | GfK Consumer Confidence Sep | -49 | -42 | -44 | |

| 07:15 | EUR | France Manufacturing PMI Sep P | 47.8 | 49.9 | 50.6 | |

| 07:15 | EUR | France Services PMI Sep P | 53 | 50.4 | 51.2 | |

| 07:30 | EUR | Germany Manufacturing PMI Sep P | 48.3 | 48.3 | 49.1 | |

| 07:30 | EUR | Germany Services PMI Sep P | 45.4 | 47.2 | 47.7 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Sep P | 48.5 | 48.8 | 49.6 | |

| 08:00 | EUR | Eurozone Services PMI Sep P | 48.9 | 49.1 | 49.8 | |

| 08:30 | GBP | Manufacturing PMI Sep P | 48.5 | 47.4 | 47.3 | |

| 08:30 | GBP | Services PMI Sep P | 49.2 | 50 | 50.9 | |

| 12:30 | CAD | Retail Sales M/M Jul | -2.50% | -2.00% | 1.10% | 0.60% |

| 12:30 | CAD | Retail Sales ex Autos M/M Jul | -3.10% | -1.00% | 0.80% | 0.60% |

| 13:45 | USD | Manufacturing PMI Sep P | 51.8 | 51.2 | 51.5 | |

| 13:45 | USD | Services PMI Sep P | 49.2 | 45 | 43.7 |