Products You May Like

New Zealand Dollar rises broadly in quiet markets today, after RBNZ delivered the 50bps rate hike as widely expected, clearing the doubt that it will follow RBA and opt for a smaller hike. Dollar remains the worst performer of the week, following strong risk rebound in stock markets, while yields weakened. Yen is the second weakest, only slightly better than Dollar. Sterling is so far the winner, continuing to reverse prior deep losses while Euro and Swiss France are also firm.

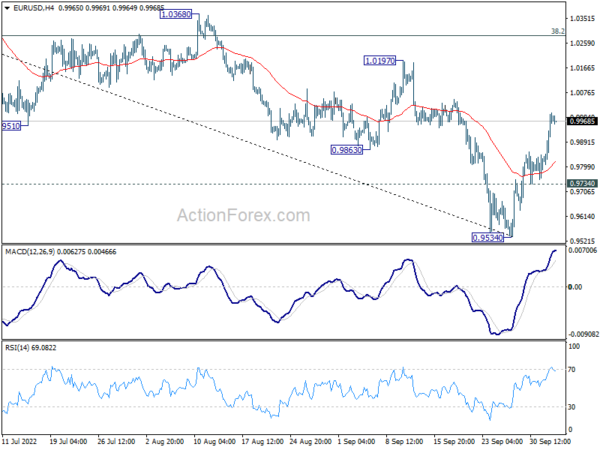

Technically, a focus for now is whether Euro and Sterling could maintain upside momentum to solidify it as a trend. 4 hour RSI in EUR/JPY is dipping back from overbought region, suggesting that there may loss of upside momentum. Break of 140.35 minor support will suggest rejection by 145.62 high, to start the third leg of the consolidation pattern from there.

In Asia, at the time of writing, Nikkei is up 0.36%. Hong Kong HSI is up 5.47%. Singapore Strait Times is up 0.35%. Japan 10-year JGB yield is up 0.0312 at 0.263. Overnight, DOW rose 2.80%. S&P 500 rose 3.06%. NASDAQ rose 3.34%. 10-year yield dropped -0.034 to 3.617.

RBNZ hikes by 50bps, considered 75bps

RBNZ raises Official Cash Rate by 50bps 3.50% as widely expected. In the summary of record it’s noted that the Committee considered whether to hike by 50bps or 75bps, but decided that 50bps was appropriate at this meeting.

In the statement, RBNZ noted that domestic spending has remained “resilient”. Employment levels are “high” while productivity capacity is “constrained” by labor shortages. wage pressures are “heightened”. Also, “spending continues to outstrip the capacity to supply goods and services, with a range of indicators continuing to highlight broad-based pricing pressures.”

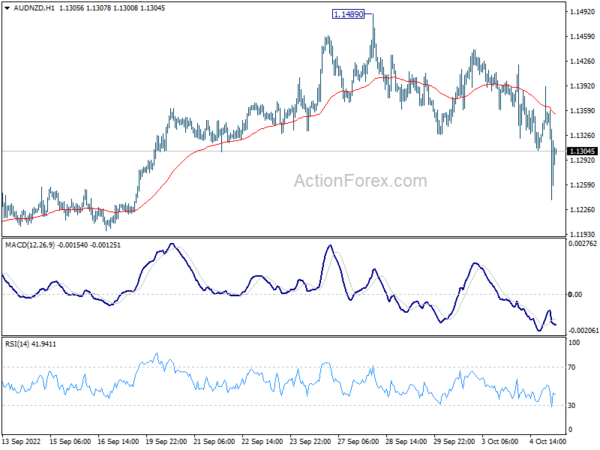

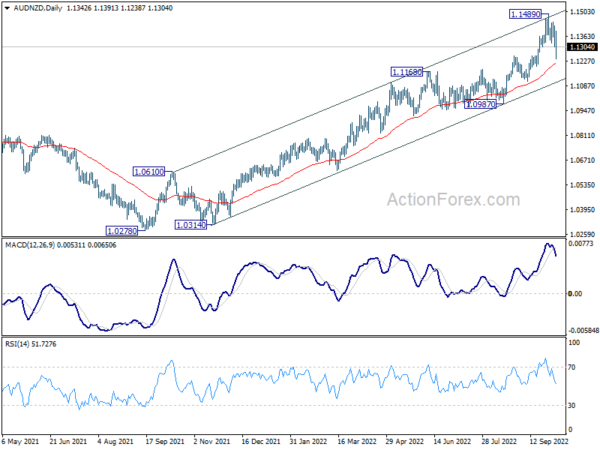

AUD/NZD topped but not reversing yet

AUD/NZD spikes lower after RBNZ’s 50bps rate hike. The development also came with the background that RBA disappointed the markets with a 25bps hike yesterday.

Technically, a short term top was in place at 1.1489 after AUD/NZD hit medium term channel resistance. But it’s still early to call for a medium term correction. As long as 55 day EMA (now at 1.1211) holds, the consolidation from 1.1489 should be relatively brief, and larger up trend should resume sooner rather than later.

However, firm break of the 55 day EMA will open up deeper correction through channel support to 1.0987, before having some support for a bounce.

Looking ahead

Germany trade balance, France industrial production, Eurozone PMI services final, and UK PMI services final will be featured in European session.

Later in the day, US will release ADP employment, trade balance and ISM services. Canada will release building permits and trade balance.

EUR/USD Daily Outlook

Daily Pivots: (S1) 0.9862; (P) 0.9930; (R1) 1.0055; More…

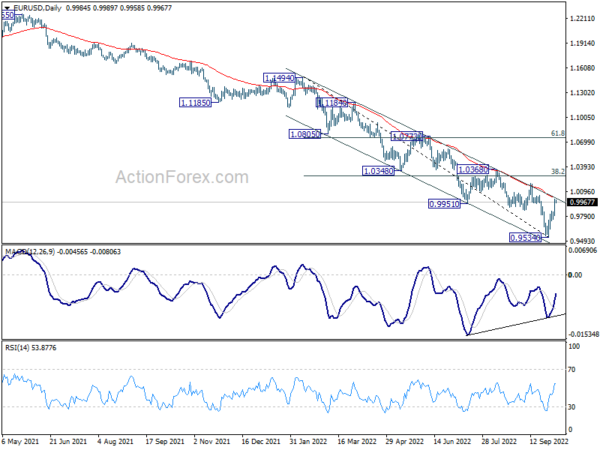

EUR/USD’s rebound from 0.9534 is still in progress and intraday bias stays on the upside. Considering bullish convergence condition in daily MACD, sustained break of 55 day EMA (now at 1.0022) will raise the chance of medium term bottoming at 0.9534. Further rally should then be seen to 38.2% retracement of 1.1494 to 0.9534 at 1.0283. On the downside, though, break of 0.9734 minor support will bring retest of 0.9534 low instead.

In the bigger picture, down trend from 1.6039 (2008 high) is still in progress. Next target is 100% projection of 1.3993 to 1.0339 from 1.2348 at 0.8694. In any case, break of 1.0197 resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will stay bearish even with strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:00 | NZD | RBNZ Interest Rate Decision | 3.50% | 3.50% | 3.00% | |

| 06:00 | EUR | Germany Trade Balance (EUR) Aug | 4.0B | 5.4B | ||

| 06:45 | EUR | France Industrial Output M/M Aug | -0.30% | -1.60% | ||

| 07:45 | Italy | Italy Services PMI Sep | 49.2 | 50.5 | ||

| 07:50 | EUR | France Services PMI Sep F | 53 | 53 | ||

| 07:55 | EUR | Germany Services PMI Sep F | 45.4 | 45.4 | ||

| 08:00 | EUR | Eurozone Services PMI Sep F | 50.2 | 48.9 | ||

| 08:30 | GBP | Services PMI Sep F | 49.2 | 49.2 | ||

| 12:15 | USD | ADP Employment Change Sep | 200K | 132K | ||

| 12:30 | USD | Trade Balance (USD) Aug | -67.8B | -70.6B | ||

| 12:30 | CAD | Building Permits M/M Aug | -0.80% | -6.60% | ||

| 12:30 | CAD | International Merchandise Trade (CAD) Aug | 3.5B | 4.1B | ||

| 13:45 | USD | Services PMI Sep F | 49.2 | 49.2 | ||

| 14:00 | USD | ISM Services PMI Sep | 56 | 56.9 | ||

| 14:30 | USD | Crude Oil Inventories | -0.2M |