Products You May Like

The markets are generally steady in Asian session today, as traders await US consumer inflation data. FOMC minutes released overnight basically provided nothing to counter the expectation of a 75bps hike by Fed in November. Today’s data might further affirm such expectations. While Dollar is firm, it’s struggling to build up momentum except versus Yen. There’s good chance for Dollar bulls jump in if the CPI data surprise on the upside.

Technically, S&P 500 stabilized a little bit after dipping to 2-year low earlier, but stays vulnerable. As long as 3806.91 resistance holds, further decline is expected. Current down trend is still in progress for 100% projection of 4818.62 to 3636.87 from 4325.28 at 3143.53 later in the year. The speed of the decline would very much depend on the Fed’s tightening pace and terminal rate, which ties to inflation outlook.

In Asia, at the time of writing, Nikkei is down -0.51%. Hong Kong HSI is down -1.00%. China Shanghai SSE is up 0.16%. Singapore Strait Times is down -1.16%. Japan 10-year JGB yield is down -0.0010 at 0.253. Overnight, DOW dropped -0.10%. S&P 500 dropped -0.33%. NASDAQ dropped -0.09%. 10-year yield dropped -0.037 to 3.902.

FOMC minutes: Many emphasized cost of doing too little

In the minutes of September 20-21 FOMC meeting, it’s noted that with “broad-based and unacceptably high level of inflation” and the “upside risks”, participants remarked that “purposefully moving to a restrictive policy stance in the near term was consistent with risk-management considerations”.

Further than that, “many participants emphasized that the cost of taking too little action to bring down inflation likely outweighed the cost of taking too much action.”

Also, “several participants underlined the need to maintain a restrictive stance for as long as necessary”.

Fed Bowman: Sizable hike on the table if inflation not moving down

Fed Governor Michelle Bowman said a speech, “if we do not see signs that inflation is moving down, my view continues to be that sizable increases in the target range for the federal funds rate should remain on the table.”

Nevertheless, “if inflation starts to decline, I believe a slower pace of rate increases would be appropriate.” Even so, “to bring inflation down in a consistent and lasting way, the federal funds rate will need to move up to a restrictive level and remain there for some time.”

“However, it is not yet clear how high we will need to raise the federal funds rate and how much time will pass before we begin to see inflation moving back down in a consistent and lasting way,” she added.

On the data front

UK RICS house price balance dropped to 32% in September, below expectation of 48%. Japan banking lending rose 2.3% yoy in September, versus expectation of 2.2% yoy. Japan PPI accelerated from 9.4% yoy to 9.7% yoy in September, well above expectation of 8.8% yoy. Australia consumer inflation expectation was unchanged at 5.4% in October.

Looking ahead, Germany will release CPI final. But focus will be on US CPI later in the day, while jobless claims will also be published.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3775; (P) 1.3803; (R1) 1.3845; More…

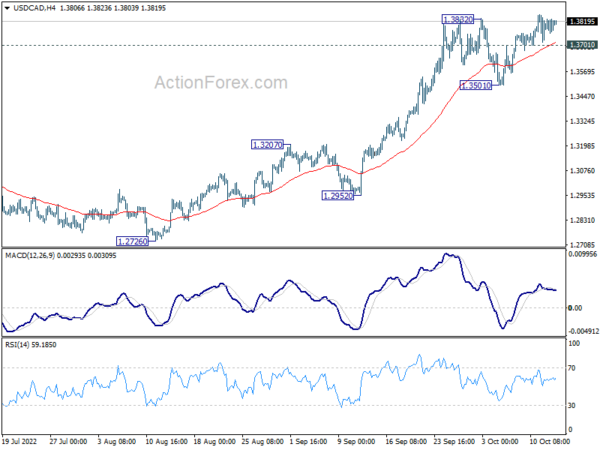

USD/CAD is losing some upside momentum as seen in 4 hour MACD. But further rise is still expected with 1.3701 minor support intact. Current up trend should target 161.8% projection of 1.2005 to 1.2947 from 1.2401 at 1.3925. Decisive break there will target 200% projection at 1.4285. On the downside, below 1.3701 will turn bias to the downside for 1.3501 support instead.

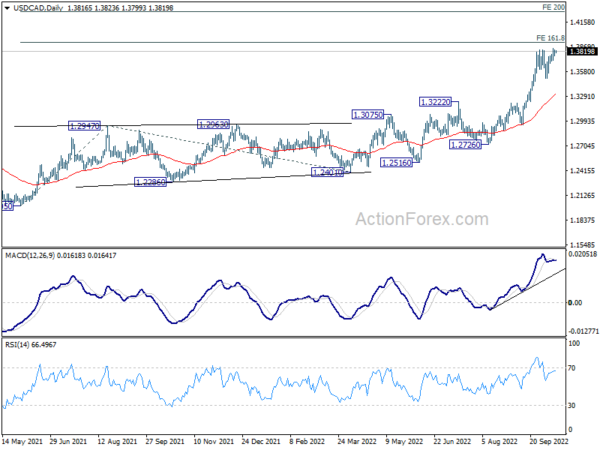

In the bigger picture, up trend from 1.2005 (2021 low) is still in progress. Based on current impulsive momentum, it could be resuming long term up trend from 0.9056 (2007 low). Whether it is or it isn’t, retest of 1.4689 (2016 high) should be seen next. This will now remain the favored case as long as 1.3222 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance Sep | 32% | 48% | 53% | 51% |

| 23:50 | JPY | Bank Lending Y/Y Sep | 2.30% | 2.20% | 1.90% | |

| 23:50 | JPY | PPI Y/Y Sep | 9.70% | 8.80% | 9.00% | 9.40% |

| 00:00 | AUD | Consumer Inflation Expectations Oct | 5.40% | 5.40% | ||

| 06:00 | EUR | Germany CPI M/M Sep F | 1.90% | 1.90% | ||

| 06:00 | EUR | Germany CPI Y/Y Sep F | 10.00% | 10.00% | ||

| 12:30 | USD | Initial Jobless Claims (Oct 7) | 225K | 219K | ||

| 12:30 | USD | CPI M/M Sep | 0.20% | 0.10% | ||

| 12:30 | USD | CPI Y/Y Sep | 8.10% | 8.30% | ||

| 12:30 | USD | CPI Core M/M Sep | 0.50% | 0.60% | ||

| 12:30 | USD | CPI Core Y/Y Sep | 6.50% | 6.30% | ||

| 14:30 | USD | Natural Gas Storage | 126B | 129B | ||

| 15:00 | USD | Crude Oil Inventories | 0.9M | -1.4M |