Products You May Like

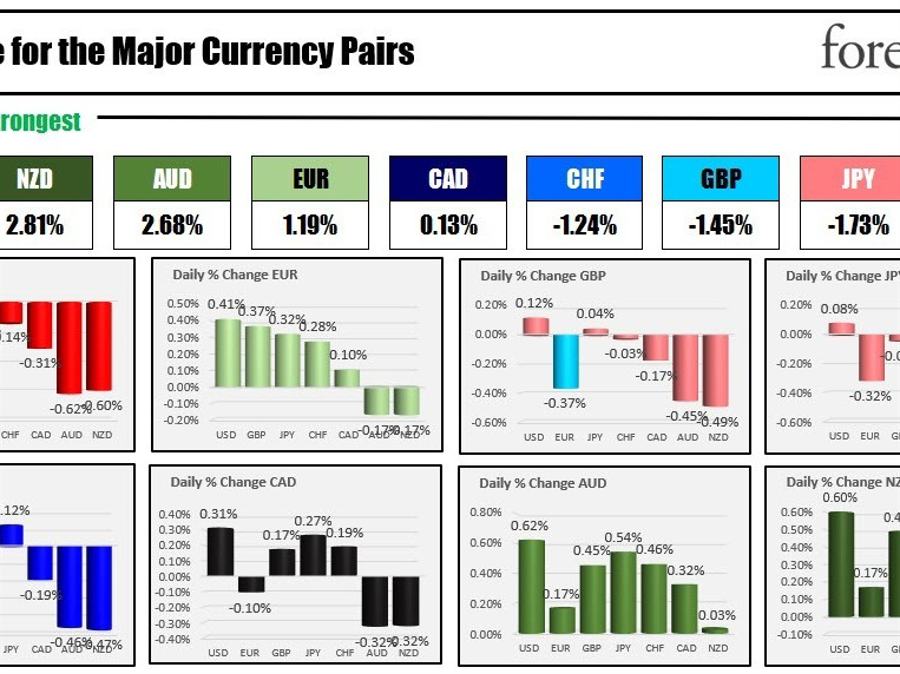

The strongest and the weakest of the major currencies

The NZD is the strongest and the USD is the weakest as the NA session begins. The UK political turmoil continues with Truss now meeting with 1922 committee chair Brady (and is being reported that “It is over” for the PM). The GBPUSD is back higher after briefly dipping below its 200 hour MA in the London morning session at 1.11913. The current price is currently at 1.1238. The 100 hour MA is above at 1.12749.

The AUDUSD is higher and making new highs in early NA trading. The employment report came in weaker than expectations with a gain of 0.9K vs 25K estimated. The pair moved lower initially but rebounded and extended back above the key 100/200 hour barometer near 0.6278 area (now risk as the bias shifts).

The USDJPY moved above the 150.00 level but quickly retreated (to 150.079). The price low reached 149.59 before rebounding a touch. The price is trading near 149.78 to start the US trading day.

The US stocks are mixed in early NY trading but recovered from earlier declines with the Nasdaq the largest decliner. Tesla is down over 5.5% in premarket trading after disappointing earnings and forward guidance.

The US yields are near unchanged after trading to 2008 highs. UK 10 year yields are lower now after trading to 4.632%, the highest level since October 2008

A look around the markets shows.

- Spot gold is trading up $7.45 or 0.46% $1636.20

- spot silver is trading up $0.22 or 1.19% at $18.65

- WTI crude oil is trading at $86.03

- Bitcoin is trading at $19,230

in the premarket for US stocks, the major indices are mixed after declining yesterday and snapping a two day winning streak:

- Dow industrial average up 98 points after yesterdays -99.99 point decline

- S&P index up 4 points after yesterdays -24.82 point decline

- NASDAQ index -7 point after yesterdays -91.89 point decline

in the European equity markets, the major indices are mixed (German DAX is lower):

- German DAX -0.4%

- France’s CAC +0.3%

- UK’s FTSE 100 +0.1%

- Spain’s Ibex +0.5%

- Italy’s FTSE MIB +0.3%

In the US debt market, the yields are little changed

US yields are marginally higher

The European debt market, the benchmark 10 year yields are also mostly higher marginally

European benchmark yields are marginally higher