Products You May Like

Markets:

- Gold up $27 to $1654

- US 10-year yields down 1 bps to 4.22%

- WTI crude oil up 48-cents to $84.99

- S&P 500 up 88 points to 3754

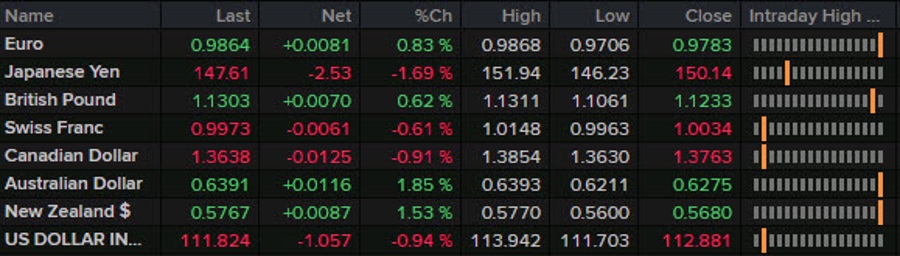

- JPY and AUD lead, USD lags

This week had it all and a good portion of it unwound today. We looked like we were going to get the 13th straight day of USD/JPY gains after the BOJ signaled no change in policy by expanding bond purchases. That kicked off a spike to 151.94 but the turn came when the Fed appeared to plant a WSJ story downplaying the odds of another 75 bps hike in December.

There was a blip in USD/JPY at the same time that might have been the start of Japanese intervention. It also kicked off a recovery in equities and cap in yields, especially at the short end.

What had been a trickle turned into a flood with some surprisingly dovish signals from some-time Powell mouthpiece Mary Daly, who is the President of the SF Fed. She indicated that 4.50-5.00% is still the Fed top, despite the market trying to price in another hike. Around the same time, the MOF came in with the hammer, intervening in USD/JPY and sending the pair lower by more than 400 pips.

The combination of dovish signals and FX intervention kicked off a rout on the US dollar with the pound reversing heavy losses despite the political turmoil. The euro and commodity currencies also staged large reversals.

May Fed funds now price 4.87%, down from 5.03% on Wednesday and the front end of the Treasury curve rallied alongside an impressive day for equities. It’s clearly a market that just wants a bit of certainty from the Fed before putting some money to work.

The weekly gains in stocks were the largest since late June with the S&P 500 up 4.7% with half of that today.

Have a wonderful and restful weekend because next week kicks off a wild run of central bank decisions.