Products You May Like

Dollar was sold off overnight as stock markets extended rebound. But there is no clear downside breakout in the greenback yet. For now, Sterling is the strongest one for the week as political situation in the UK appears to have stabilized. Euro is the second best as helped by rally against Swiss Franc. Dollar is just the third weakest, following Yen and Kiwi. Canadian Dollar is mixed and will look forward to today’s BoC rate decision for guidance.

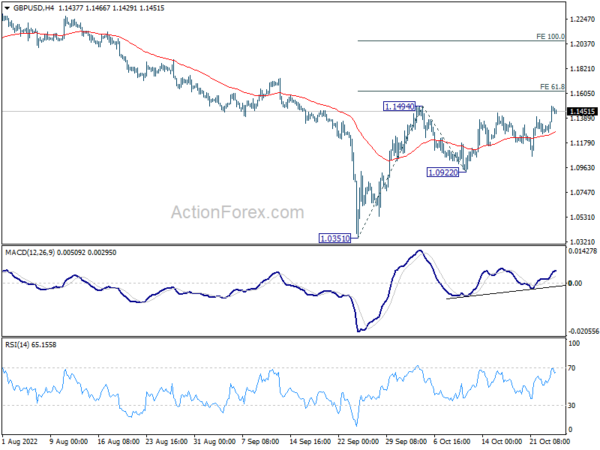

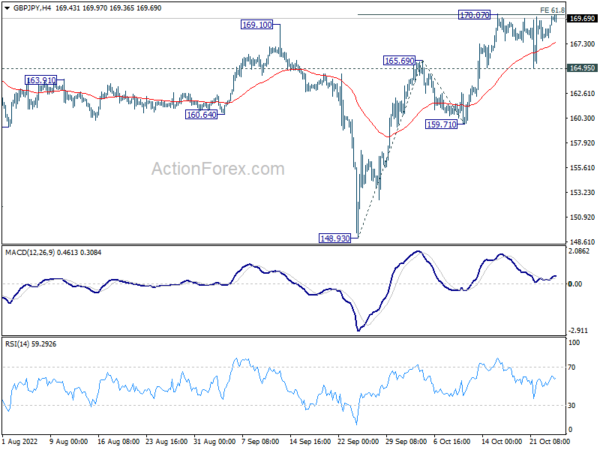

Technically, focus is back to 0.9998 resistance in EUR/USD and 1.1494 resistance in GBP/USD. Firm break of these levels will confirm resumption of rebound from 0.9534 and 1.0351 respectively. If happen this could be a signal of more Dollar weakness elsewhere. In particular, USD/CAD could then be dragged through 1.3501 support. But then, another scenario would be upside break out in EUR/JPY and GBP/JPY through 148.38 and 170.07. Let’s see.

In Asia, at the time of writing, Nikkei is up 1.06%. Hong Kong HSI is up 2.17%. China Shanghai SSE is up 1.42%. Singapore Strait Times is up 0.99%. Japan 10-year JGB yield is down -0.0046 at 0.252. Overnight, DOW rose 1.07%. S&P 500 rose 1.63%. NASDAQ rose 2.25%. 10-year yield dropped -0.126 to 4.108.

Australia CPI jumped to 7.3% yoy in Q3, highest since 1990

Australia CPI rose 1.8% qoq in Q3, above expectation of 1.5% qoq. Annual rate accelerated from 6.1% yoy to 7.3% yoy, above expectation of 6.9% yoy. That’s the highest annual rise since 1990. Trimmed mean CPI, which excludes large price rises and falls, accelerated from 4.9% yoy to 6.1% yoy, highest since the data first published in 2003.

For the quarter, the most significant contributors to the rise were new dwellings (+3.7%), gas (+10.9%) and furniture (+6.6%). Annually, new dwellings (+20.7%) and automotive fuel (+18.0%) were the most significant contributors.

NZ ANZ business confidence fell to -42.7, murky outlook but resilient

New Zealand ANZ Business Confidence fell from -36.7 to -42.7 in October. Looking at some details, Own Activity Outlook dropped from -1.8 to -2.5. Cost expectations dropped from 89.8 to 88.6. Employment intentions dropped from 5.9 to 5.0. Price intentions dropped from 68.0 to 64.5. Inflation expectations rebounded from 5.98 to 6.13.

ANZ said: “The economic outlook is certainly murky, but the New Zealand economy has a lot going for it. Debt is higher, but nowhere near the worrying levels other economies are struggling under. We’re relatively insulated from the energy cost implications of Russia’s invasion of Ukraine. Our primary export base is food, and when it comes down to it, people gotta eat. Housing affordability has improved in a meaningful but so far remarkably painless fashion. Indeed, overall the economy is still surprising economists with its resilience. It’s a rougher path ahead, but the country is still moving forward.”

BoC to hike 75bps, may signal slower tightening ahead

BoC is widely expected to deliver another rate hike today. The markets seem to have now reached a consensus expectation of a 75bps increase in overnight rate to 4.00%. That would be the highest level since 2008. The tightening cycle shouldn’t stop there, but BoC may indicate that the pace would slow ahead. Some analysts are expecting another 50bps hike in December, followed by a 25bps hike early next year. But the decisions beyond together will very depend on upcoming economic data.

Here are some previews on BoC:

USD/CAD’s up trend was capped at 1.3976 earlier this month, on overbought condition. For now, further rise is expected as long as 1.3501 support holds. Up trend from 1.2005 would target 200% projection of 1.2005 to 1.2947 from 1.2401 at 1.4285 on break of 1.3976. Nevertheless, break of 1.3501 support will bring deeper fall to 55 day EMA (now at 1.3430) and below.

Elsewhere

Eurozone M3 money supply and Swiss Credit Suisse economic expectations are the only feature in European session. US will release goods trade balance, whole sales inventories and new home sales.

GBP/JPY Daily Outlook

Daily Pivots: (S1) 168.43; (P) 169.19; (R1) 170.53; More…

GBP/JPY is staying below 170.07 and intraday bias remains neutral. But further rally is still in favor. Firm break of 170.07 will confirm up trend resumption. Next target is 100% projection of 148.93 to 165.69 from 159.71 at 176.47. Nevertheless, break of 164.95 minor support will turn bias back to the downside for 159.71 support instead.

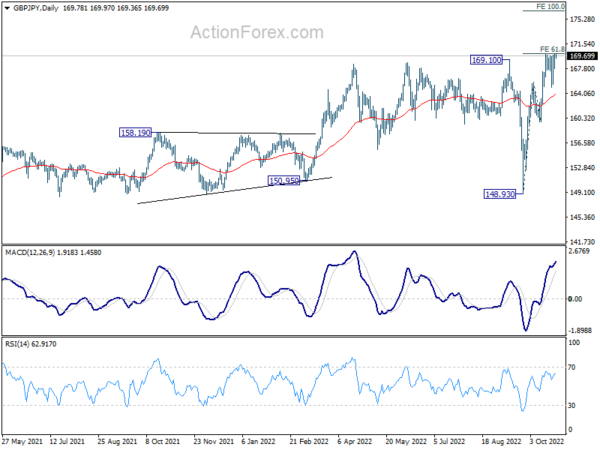

In the bigger picture, current development suggests that up trend from 123.94 (2020 low) is still in progress. Sustained break of 61.8% retracement of 195.86 (2015 high) to 122.75 (2016 low) at 167.93 will pave the way to retest 195.86 high. This will now remain the favored case as long as 148.93 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y Sep | 2.10% | 1.80% | 1.90% | 2.00% |

| 00:00 | NZD | ANZ Business Confidence Oct | -42.7 | -36.7 | ||

| 00:30 | AUD | CPI Q/Q Q3 | 1.80% | 1.50% | 1.80% | |

| 00:30 | AUD | CPI Y/Y Q3 | 7.30% | 6.90% | 6.10% | |

| 00:30 | AUD | RBA Trimmed Mean CPI Q/Q Q3 | 1.80% | 1.50% | 1.50% | 1.60% |

| 00:30 | AUD | RBA Trimmed Mean CPI Y/Y Q3 | 6.10% | 5.60% | 4.90% | |

| 08:00 | CHF | Credit Suisse Economic Expectations Oct | -69.2 | |||

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Sep | 6.10% | 6.10% | ||

| 12:30 | USD | Goods Trade Balance (USD) Sep P | -87.8B | -87.3B | ||

| 12:30 | USD | Wholesale Inventories Sep P | 1.30% | 1.30% | ||

| 14:00 | USD | New Home Sales Sep | 590K | 685K | ||

| 14:00 | CAD | BoC Interest Rate Decision | 4.00% | 3.25% | ||

| 14:30 | USD | Crude Oil Inventories | -0.3M | -1.7M | ||

| 15:00 | CAD | BoC Press Conference |