Products You May Like

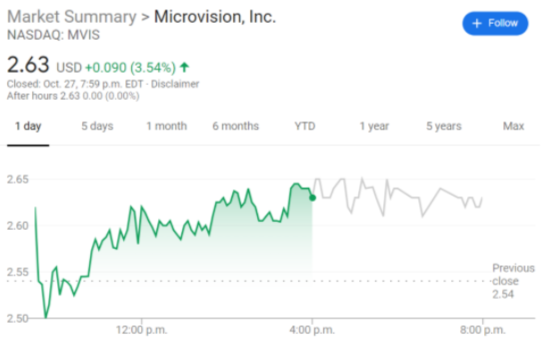

- NASDAQ:MVIS continues with its momentum from Monday as the stock rose a further 3.54%.

- Ladenburg Thalmann analyst reiterates buy rating and sets new price target.

- Microvision announces quarterly earnings call on October 29th, 2020.

NASDAQ:MVIS has continued its rally from the previous day as the stock rose a further 3.54% on Tuesday to close the trading session at $2.63. The rise today follows a near 10% surge on Monday after several months of trading at relatively flat levels. Year-to-date, the stock has performed admirably despite the coronavirus pandemic and has returned nearly 250% to investors so far. After the two-day surge shares are now trading well above Microvision’s 50-day and 200-day moving averages and is trending sharply upwards ahead of its quarterly earnings call.

That earnings call has officially been scheduled for October 29th, 2020, and analysts are optimistic that the laser-scanning technology maker can continue to build on its current momentum. Ladenburg Thalmann reiterated its buy position on Microvision and raised its price target for the stock up to $4.20. The new price target represents a fairly healthy 60% increase over Tuesday’s closing price as well as a 21% increase over the 52-week high price of $3.45. The Redmond, Washington based firm has been rumoured for a while to be a buyout candidate by another Redmond-based company known as Microsoft (NASDAQ:MSFT), although these rumours have long been denied by the tech giant.

NASDAQ:MVIS news

According to some analysts, the expected consensus earnings per share number for MVIS is estimated at $-0.02, while this figure in the same quarter last year was $-0.05 per share. Speculation of a future contact with another tech giant Apple (NASDAQ:AAPL) to use Microvision’s laser technology in the newest iteration of its IPhone has also caused the stock to spike leading up to Apple’s unveiling in mid-October. Just as with the Microsoft rumours, nothing has come to fruition in regards to working with Apple, yet.