Products You May Like

- Apple is little affected by the poor performance of Wall Streeet.

- The tech giant stock is still below $150 and rangebound.

- AAPL is likely to follow the market higher.

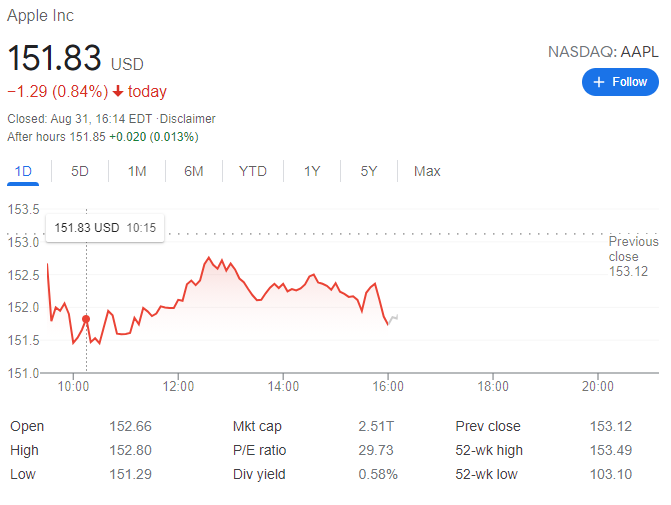

Update August 31: AAPL ended Tuesday down 0.84% at $151.83, retreating from an intraday high of $152.80. The share hit an all-time high on Monday after market talks suggested that Google could increase its annual fee to retain its place as the default search option on iOS to $15 billion this year. The AAPL retreated just modestly amid investors adopting a cautious stance ahead of the release of US employment-related data, that can twists Federal Reserve Chair Jerome Powell’s view on tapering.

t

Apple stock pushed a bit higher in a relatively calm day trading on Friday, as the Fed Chair Powell delivered the perfect testimony to the Jackson Hole symposium. Nothing too surprising or damaging to market sentiment, as Powell tread a carefully worn path of keeping the market happy. The equity market has been nervous ahead of the meeting with more inflation measures rising with the PCE figure on Friday hitting a peak not seen since the 1990s.

It now seems increasingly clear that inflation is not transitory and is likely going to last for much longer than the Fed had initially hoped. However, the market has overlooked this for now and staged a relief rally on the lack of too much taper as Fed Chair Powell remains the market’s best friend. Apple is the stock-market leader and rallied accordingly, along with everything else. The stock had been increasingly rangebound and despite the 0.72% gain on Friday, it still is largely sideways. In fact, Friday’s move only served to take Apple back to the 9-day moving average, hardly something to get excited about. The stock is still sitting dangerously close to the lower end of the wedge formation.

Apple key statistics

| Market Cap | $2.5 trillion |

| Enterprise Value | $2.3 trillion |

| Price/Earnings (P/E) | 29 |

|

Price/Book |

38 |

| Price/Sales | 9 |

| Gross Margin | 41% |

| Net Margin | 25% |

| EBITDA | $112 billion |

| 52 week low | $103.10 |

| 52 week high | $151.68 |

| Average Wall Street rating and price target |

Buy $165 |

Apple stock forecast

Apple needs to achieve a few targets in the short term to get out of the boring sameness of the last few sessions. Firstly, it needs to break $150 and snap the four day series of lower highs. Apple has not been above $150 since early last week so it needs to get above this level sharpish. That will then open things up for a push to new all-time highs and break out of the wedge formation. The stock also eneds to rid itself of the bearish divergence across the main momentum oscillators. The Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) are all trending lower and have been for some time despite Apple making new all-time highs.

Key short-term suport is $144.50, breaking here sees volume thin out meaning a break could accelerate to the next key support at $141.67. Below, there is a complete volume vaccum until the mid $130s, which strengthens the importance of holding the first $144.50 support.

Like this article? Help us with some feedback by answering this survey:

-637659071960998199.png)