Products You May Like

Forex news for North American trading on October 1, 2021

The US core PCE data for the month of August remain steady at 3.6%. That was the expected rate as well. Although inflation remains well above the 2% level, the expectations are that some of the gains are transitory and will come down over time. However, the risks still remain to the upside. Fed’s Mester said today that she expects inflation to remain above 2% next year and the year after. Feds Harker today also talked of higher inflation saying that he’s penciling in a significant risk of higher inflation, and that some business leaders are saying there could be years to resolve supply chains.

In other fundamental news today, the ISM manufacturing index came in at a strong 61.1% versus 59.6% but construction spending was unchanged versus 0.3% estimate for the month of August. The Michigan consumer sentiment came in hundred 72.8 versus 71.0 expect. So overall not a bad day as far as economic data goes.

In the markets, there was some support premarket after news that Merck was looking to fast track a Covid drug that would lower hospitalizations by 50% for those infected. That finally sent Merck shares higher but also the stocks like airlines and Disney also surged on hopes for a more normal economy going forward. Will that get people back to work?

Next week we get the US jobs report on Friday with expectations for 490K increase in jobs. That is down from higher levels for the recovery, but would be up from the 235K surprise reading last month. Despite the weaker report last month, the Fed chair Powell said this week that employment gains were on track and that is not necessary to seek blockbuster job gains going forward.

US stocks today moved higher across the board with the Dow industrial average leading the way thanks to Merck (+8.4%), Disney (+4.1%) and American Express (+3.8%). A look at the final numbers in the stock market shows:

- Dow Jones industrial average +482.54 points or +1.43% at 34326.46. At the highs, the index was up 705.02 points

- S&P index rose 49.51 points or 1.15% at 4357.05. At the highs it was up 87.41 points

- NASDAQ index rose 118.12 points or 0.82% at 14566.70. At its highs it was up 158.2 points.

In the US debt market, yields came down by -5.8 basis points and is back below the 1.500% level at 1.4669%. For the week, the yield closed last Friday at 1.454%. With the decline today, the tenure is only up 1.5 basis points on the week. The high yield did extend to 1.56% on September 29 before starting its move back to the downside of the last few days.

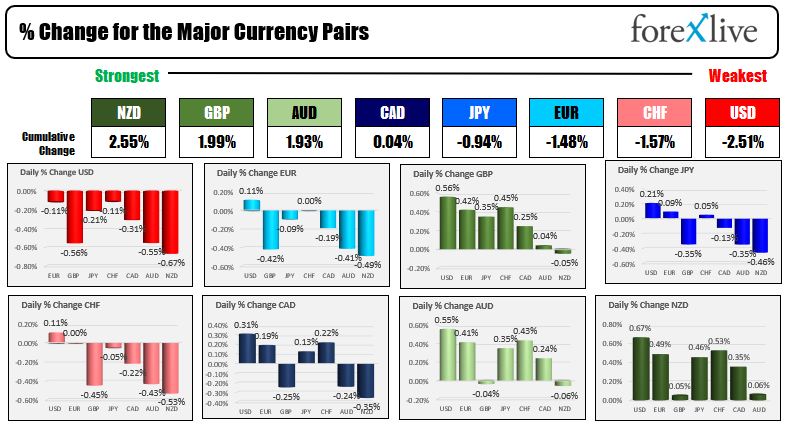

In the forex market, the NZD is ending the day is the strongest of the major currencies. Next week, the Reserve Bank of New Zealand is expected to raise rates by 0.25% to 0.5%. Although the pair moved higher over the last two trading days, it still is lower on the week (it closed last week near the 0.7000 level and is trading at 0.6942 level currently but well off the low of 0.68569 reached at the start of trading on Thursday.

The USD is the weakest of the majors today falling by 0.67% verse the NZD, 0.56% versus the GBP and 0.55% verse the AUD. The decline was helped by the lower US yields along with less “risk off flows” into the relative safety of the USD.

There were also some technical breaks which contributed to the dollar selling:

- GBPUSD: The GBPUSD move back above its 100 hour moving average currently at 1.35260, but remains below its 200 hour moving average 1.3600. In between sets the 50% midpoint of the move down from the September 23 high at 1.3580. It would take a move above the 200 hour moving average to increase the bullish bias. A move back below the 100 hour moving average would tilt the bias back to the downside

- USDJPY: The USDJPY traded above and below its 100 hour moving average early in the Asian session, but after the last move below the moving average, the selling pushed further away. The low price saw the price move below the 38.2% retracement of the move up from the September 22 low at 110.943, but could not maintain that downward momentum. The price is trading just above the level at 111.06 going into the close. In the new trading week a move below the 38.2% retracement along with the rising 200 hour moving average at 110.77 level would increase the bearish bias at least in the short term

- USDCAD: The USDCAD spent the North American session below its 100 hour moving average currently at 1.2686. The high corrective price in the North American session reach 1.26853 - just below that key moving average level. The next key target comes near the 1.2609 to 1.26148 area (swing area). The low for the week at 1.2600 will also be a key downside target in the new trading week. On the topside it would take a move back above the 100 hour moving average at 1.2686 and the 200 hour moving average at 1.26982 to increase the bullish bias.

- EURUSD: The EURUSD spent the North American session moving up and down in a consolidative fashion. The high price in the North American session 1.16068. That was within the key swing area floor between 1.1601 to 1.1611 going back to the September and November 2020 lows. Both yesterday and today, the price highs stalled within that range. Going into the new trading week that area remains a key resistance target. Stay below is more bearish. Move above and there could be some additional short covering

- AUDUSD: The AUDUSD price move back above its 100 hour moving average at 0.7234 and 200 hour moving average at 0.7248. The current price is trading at 0.7262. In the new trading week, stay above those moving averages and the bias remains the upside. Move below, and sellers retake more of the control.

- NZDUSD: The NZDUSD – like the AUDUSD - saw its price move above its 100 hour moving average currently at 0.69269. However, the price remains well below its 200 hour moving average at 0.69758. Those moving averages will be barometers for traders in the new trading week.